CoinShares Reports $795 Million Outflows from Institutional Crypto Products

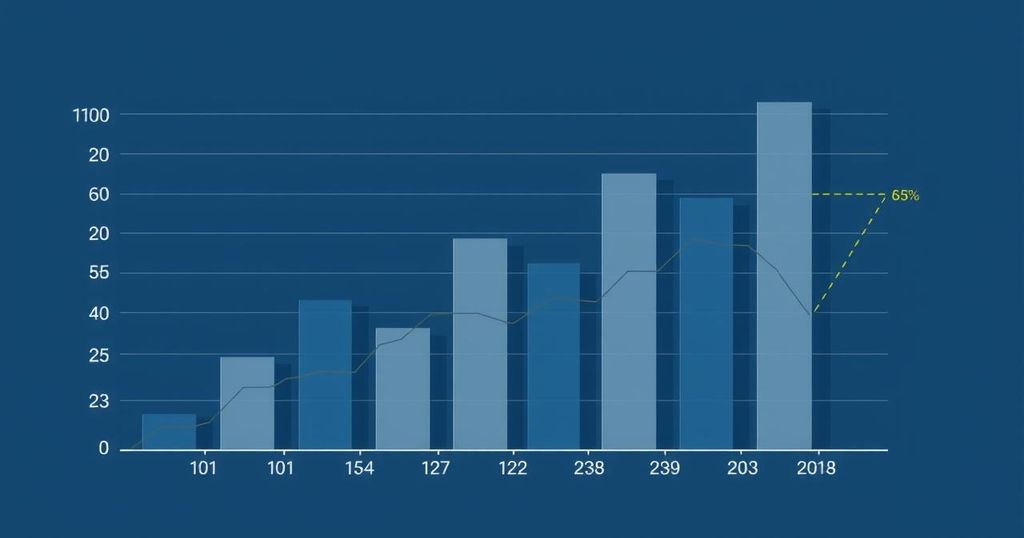

CoinShares reports institutional crypto investment products experienced $795 million in outflows due to negative sentiment linked to President Trump’s tariff policies. This marks the third week of consecutive outflows, totalling $7.2 billion since February and reversing nearly all year-to-date inflows, which now stand at $165 million. Despite heavy losses, a minor rebound in the market increased assets under management to $130 billion, driven primarily by Bitcoin’s significant outflows.

Institutional outflows from crypto investment products have reached $795 million, significantly influenced by ongoing tariff issues under President Trump’s administration. According to CoinShares’ latest report, these outflows have now exceeded the total inflows for the year, moving from a position of growth to substantial losses for the crypto sector.

For three consecutive weeks, digital asset products have reported outflows, accumulating to record figures totalling $7.2 billion since early February this year. The unfortunate development has significantly impacted year-to-date inflows, which have dropped to just $165 million. Despite this, a slight price recovery at the end of the reporting week has provided some relief, increasing total assets under management (AuM) to $130 billion, an increase of 8%.

Bitcoin emerged as the primary contributor to these outflows, with $751 million leaving the market in the last week alone. Ethereum experienced outflows of $37.6 million over the same timeframe, while other cryptocurrencies like Solana, AAVE, and SUI saw losses of $5.1 million, $0.78 million, and $0.58 million respectively.

On the other hand, some smaller altcoins observed minor inflows during this period, with XRP leading at $3.5 million, followed by Ondo, Algorand, and Avalanche, which saw inflows of $0.46 million, $0.25 million, and $0.25 million respectively.

Overall, the sentiment surrounding digital assets remains cautious due to the high volatility and macroeconomic factors affecting market conditions. Investors are encouraged to conduct thorough due diligence before engaging in any high-risk investment activities in the crypto space, acknowledging that subsequent losses are their own responsibility.

Disclaimer: The views expressed herein are not to be construed as investment advice. Investors should always consult with professional advisors prior to proceeding with any investment decision, especially in volatile markets such as cryptocurrencies.

Post Comment