Assessing Bitcoin’s Open Interest and Future Price Projections

Despite a significant decline in Bitcoin’s price, open interest remains high at $56.17 billion, which could hinder recovery efforts. Historical trends suggest that lower open interest correlates with upward price momentum. Analysts foresee a potential further decline in price to around $69,149, influenced by factors like false bullish signals and broken trendline support.

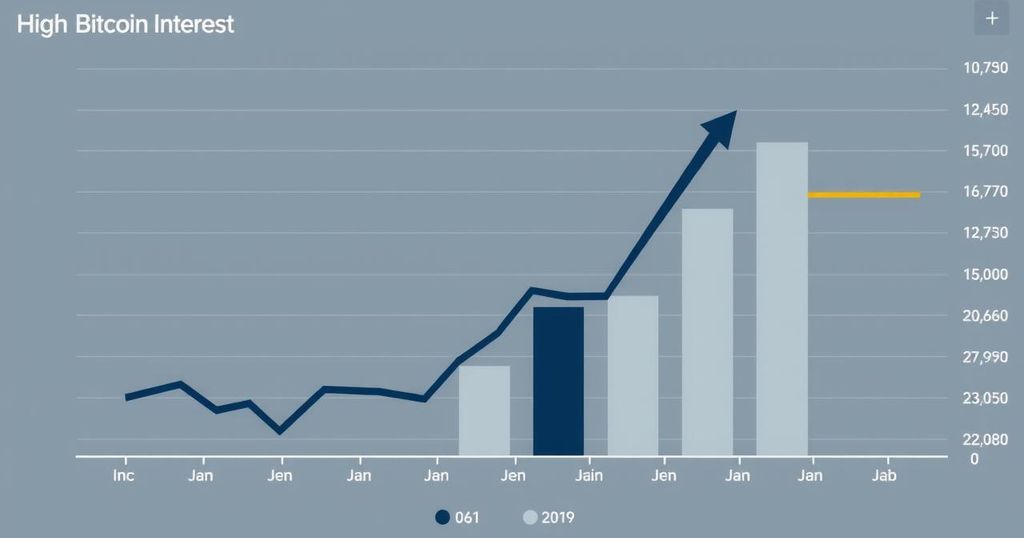

The Bitcoin open interest remains elevated despite notable price declines, indicating persistent interest in BTC. This ongoing engagement is beneficial for the crypto ecosystem in the long term. However, historical trends suggest that this high open interest could potentially impede a price recovery for Bitcoin.

Currently, Bitcoin’s open interest stands at approximately $56.17 billion, reflecting a 22% decline from its peak of $71.85 billion. The substantial open interest reveals that traders continue to stake significant positions in Bitcoin, even as its price has diminished over 20% since its previous high. This scenario raises concerns as a high open interest may pose negative implications for BTC’s future price movements.

Analysis indicates that Bitcoin typically experiences significant upward movements when open interest is low, as reduced market pressure allows bullish traders to thrive. Therefore, with the open interest still markedly elevated, the potential for upward price momentum may be constrained, suggesting that further price reduction could occur before any recovery.

Concerns regarding a potential drop in Bitcoin’s price below $70,000 have been highlighted by analysts. Notably, signs of a false bullish divergence have appeared, where the Relative Strength Index shows bullish signals not reflected in actual price movements, indicating a potential bull trap. Additionally, the breaking of a key trendline support in the low $80,000s suggests waning bullish momentum.

Given these indicators, analysts predict a further 20% decline in Bitcoin’s value, setting a target of $69,149. This level aligns with both a mid-channel support line and a previous price structure, reinforcing the analyst’s outlook.

Post Comment