US Exchanges Experience Shift in Bitcoin Volume Dominance

US exchanges are experiencing a resurgence in Bitcoin trading volume dominance compared to offshore platforms, driven by a rising US vs. Off-Shore Ratio. Although there’s been a recent decline in this ratio, it remains above 1, indicating continued dominance. Historical trends suggest that a crossover in moving averages could signal further bullish activity. Bitcoin’s current price stands at around $84,000, having surged over 10% in the last week.

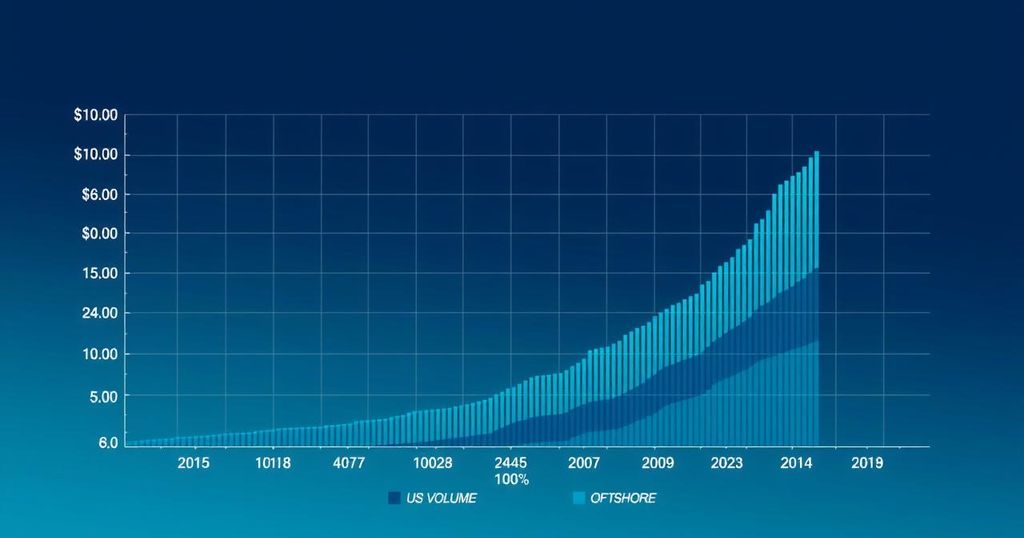

Recent on-chain data indicates a significant shift in Bitcoin trading volume on US exchanges compared to offshore platforms. The “US vs. Off-Shore Ratio” measures the Bitcoin volume on American exchanges versus that on foreign exchanges. A ratio above 1 signifies dominance of US platforms, while a value below suggests higher trading activity offshore.

Currently, the US vs. Off-Shore Ratio has risen sharply in recent weeks, surpassing the 1 mark in 2023, which denotes a resurgence of US exchange dominance. This trend reflects heightened trading on American platforms, although a recent decline has been observed, yet they retain a marginal edge with the ratio still over 1.

The upward movement of the US vs. Off-Shore Ratio signals potential bullish momentum. An earlier comparison traces back to when the ratio soared near Bitcoin’s price reaching $60,000, which preceded a significant price rally.

However, confirmation of this current upward trend requires monitoring the 90-day and 365-day Simple Moving Averages (SMAs). Historically, such a crossover between these averages aligns with an upswing in trading volume on US exchanges, potentially indicating a bullish period ahead for Bitcoin. As of the latest information, Bitcoin is valued at approximately $84,000, reflecting a >10% increase over the last week despite a recent dip.

Post Comment