Bitcoin Faces Crucial Resistance Above $88,000: Analysis and Implications

Bitcoin is encountering significant resistance above $88,000, primarily marked by the 200-day SMA at $88,356 and the Ichimoku cloud. These levels are essential for determining the future price trajectory. Behavioural trading aspects may influence whether Bitcoin breaks above resistance or experiences a downturn, affected by traders’ profit-taking behaviours.

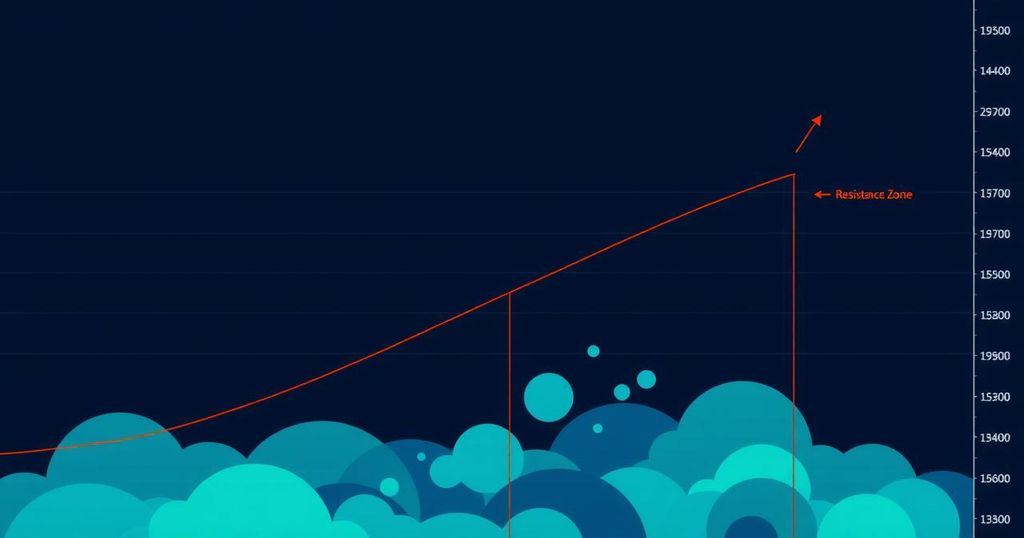

Bitcoin is currently facing a critical resistance zone above $88,000, with the most pivotal level being the 200-day simple moving average (SMA) set at $88,356. This level is a significant benchmark for assessing long-term price momentum. Analysts previously indicated that breaking below the 200-day SMA earlier this month might suggest the potential onset of a crypto winter, highlighting the importance of reclaiming this level for bullish sentiment.

In conjunction with the 200-day SMA, the Ichimoku cloud’s upper boundary aligns closely with this resistance level, indicating another point of significance. The Ichimoku cloud, devised in the 1960s, comprises five lines that together represent market momentum, support, and resistance levels, including Leading Span A, Leading Span B, Conversion Line (Tenkan-Sen), Base Line (Kijun-Sen), and a lagging price line, with the space between Leading Spans forming the cloud itself.

Additionally, the resistance cluster includes a historical high of $88,804 reached on March 24, a point after which the market declined to around $75,000. This cluster creates a critical juncture where trading behaviour could largely dictate Bitcoin’s near-term trajectory.

Behavioural finance principles like prospect theory reveal traders’ tendencies as they approach significant resistance levels. Typically, traders exhibit caution towards locking in profits while more willingly maintaining losing positions, a phenomenon described as the “reflection effect.” Thus, individuals who entered at approximately $75,000 may feel compelled to realise profits as the price nears resistance, potentially stalling or reversing any upward momentum.

Conversely, should Bitcoin securely breach the resistance levels, this could trigger a fear-of-missing-out (FOMO) effect among traders, rallying additional bullish bets and catalysing further price increments. Observing these behavioural dynamics is crucial for anticipating Bitcoin’s movement in this critical resistance zone.

Omkar Godbole, Co-Managing Editor at CoinDesk’s Markets team, provides insights into these market dynamics. With a background in Finance and as a Chartered Market Technician, Omkar previously conducted research at FXStreet and has experience analysing currency and commodities markets. Currently, he holds modest amounts of Bitcoin, Ether, and other cryptocurrencies.

Post Comment