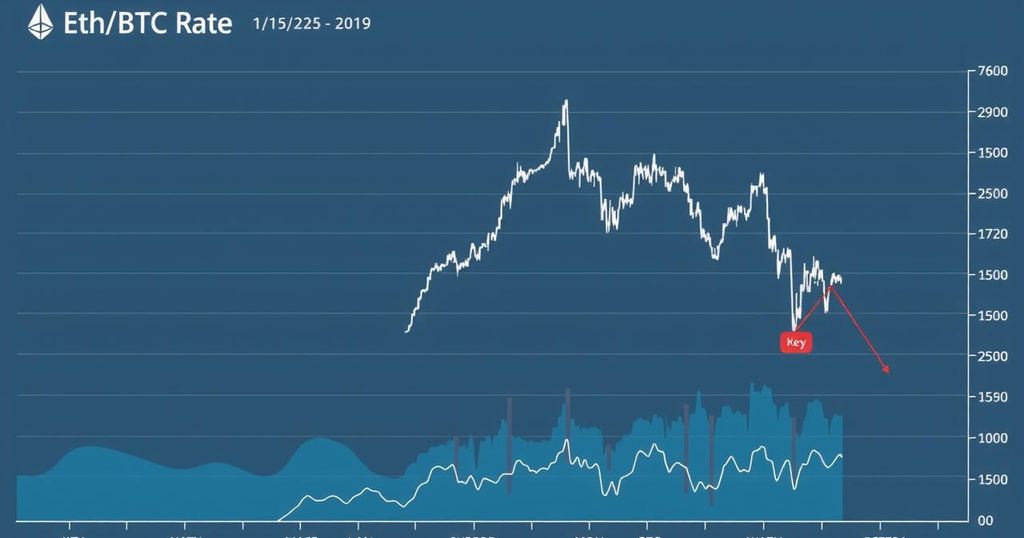

ETH/BTC Falls to 2020 Low Amid Intensified Whale Selling Pressure

The ETH/BTC exchange rate has fallen to 0.01791, the lowest since 2020, amidst increasing sell-offs by significant players like Galaxy Digital and Paradigm. Concerns mount as Ethereum’s value declines relative to Bitcoin, with a low staking ratio of 28% further diminishing investor confidence. Despite its strong position in the DeFi market, ongoing whale activities may lead to a sustained downturn for ETH unless conditions change.

Recent data from TradingView indicates that the ETH/BTC exchange rate has dropped to 0.01791, reaching its lowest point since 2020. This decline coincides with increased selling activities by major Ethereum entities, including institutions such as Galaxy Digital, Paradigm, and associates of the Ethereum Foundation, which overall escalates market pressure on ETH prices.

On April 22, 2025, Galaxy Digital transferred an additional 5,000 ETH, approximately valued at $8.11 million, to Binance. Earlier, on April 18, 2025, concerns arose when Galaxy Digital moved nearly $100 million of ETH to exchanges, raising speculation about potential large-scale sell-offs. Paradigm also transferred 5,500 ETH to Anchorage Digital, which translates to about $8.65 million. Additionally, an address connected to the Ethereum Foundation deposited 1,000 ETH (near $1.57 million) to Kraken, further impacting price levels.

The decline in the ETH/BTC ratio signals weakened value for Ethereum against Bitcoin, with Bitcoin nearing $90,000 while ETH trades at $1,574, down 2.5% in the past 24 hours. This widening gap may push investors towards Bitcoin as they seek stability, exacerbating the downward trend for ETH.

The Ethereum Foundation’s recurrent sales of ETH raise further concerns about potential price volatility, complicating ETH’s growth trajectory. Furthermore, Ethereum’s staking ratio sits at only 28%—significantly below competitors like Solana at 65%—which may reduce investor confidence, especially as Bitcoin dominance reaches a four-year high, suggesting capital is diverting from Ethereum and other altcoins.

Despite these worrying indicators, some analysts remain hopeful about Ethereum’s long-term potential. Ethereum continues to lead the DeFi and NFT sectors, with a total value locked exceeding $45 billion as of April 2025. Planned upgrades, including the transition to Ethereum 2.0 and a complete shift to Proof-of-Stake, may enhance Ethereum’s market attractiveness.

Nevertheless, investors are advised to act cautiously due to the pressing sell-off from whales. Persistent selling activity may propel ETH into a more profound decline, particularly since the ETH/BTC ratio shows limited signs of recovery.

Post Comment