Bitcoin Exchange Outflows Reach Two-Year Lows as Whales Accumulate BTC

Bitcoin exchanges are seeing their most negative net flows since early 2021, with balances at multiyear lows. Whale investors are accumulating BTC while retail investors exhibit panic selling. Analysis suggests this could indicate a re-accumulation of assets, reflecting historical patterns as BTC demand diverges among different investor groups.

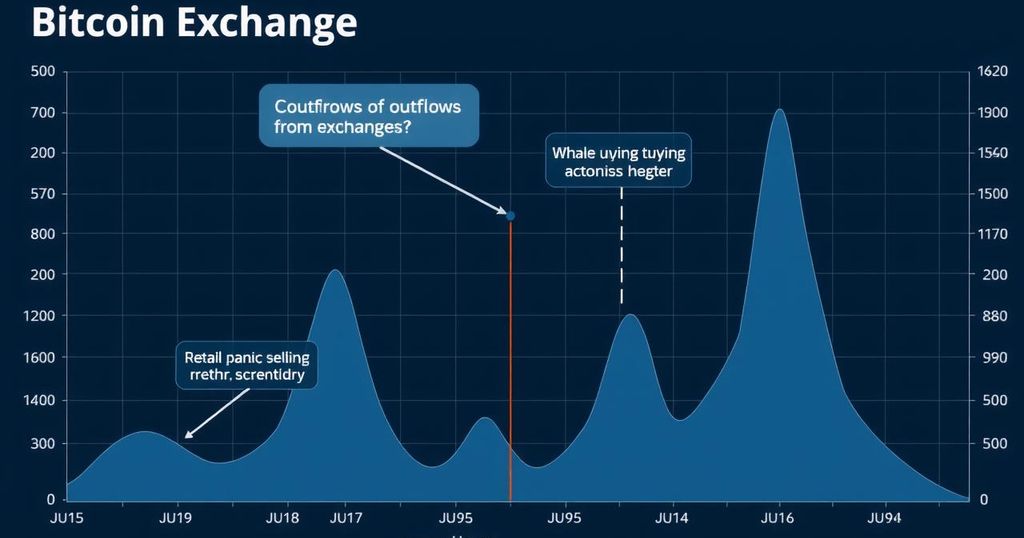

Bitcoin exchange net flows have recently shown the most negative average in over two years, indicating substantial outflows as user activity diminishes. This decline coincides with major exchanges reaching multiyear low balances. The current market behaviour resembles the end of the 2022 bear market, with significant whale activity contrasting against retail investors engaging in panic selling.

Notably, recent analysis from CryptoQuant highlights a concerning aspect of Bitcoin’s demand trajectory, stating that the 100-day simple moving average of exchange net flows has hit its most negative figure in two years. This trend suggests that outflows are exceeding inflows, indicating a stronger demand for holding Bitcoin rather than selling it through exchanges. Exchange balances reflected this trend, plummeting to approximately 2.535 million BTC in early April, a significant drop of over 7% since the beginning of 2023.

Conversely, larger investors, or whales, have actively increased their Bitcoin holdings during this period. Data reveals that entities holding between 1,000 to 10,000 BTC continued to purchase Bitcoin even amidst price reductions. Analyst Miles Deutscher noted this trend on social media, stating that every decline in price led to further accumulation by these whales, who thrive on the panic sales from smaller retail investors.

Research from Santiment backs this up, confirming that wallets containing between 10 and 10,000 BTC account for approximately 67.77% of total Bitcoin supply. These stakeholders have continued to accumulate during recent market volatility, adding over 53,600 BTC since March 22nd. Investors must navigate this landscape carefully, as trading and investments carry inherent risks. Research is vital when considering any financial decisions.

Post Comment