Weak Ethereum ETF Flows Raise Concerns Over Institutional Interest

Ethereum ETFs have seen only one day of positive flows out of the last three, highlighting weak institutional demand for ETH. While there was a brief recovery in prices, this could be undermined by declining interest from institutional investors. In contrast, Bitcoin remains strong in ETF inflows, raising questions about the future of Ethereum in the market. Exchange reserve trends also suggest possible future movement, further complicating ETH’s outlook.

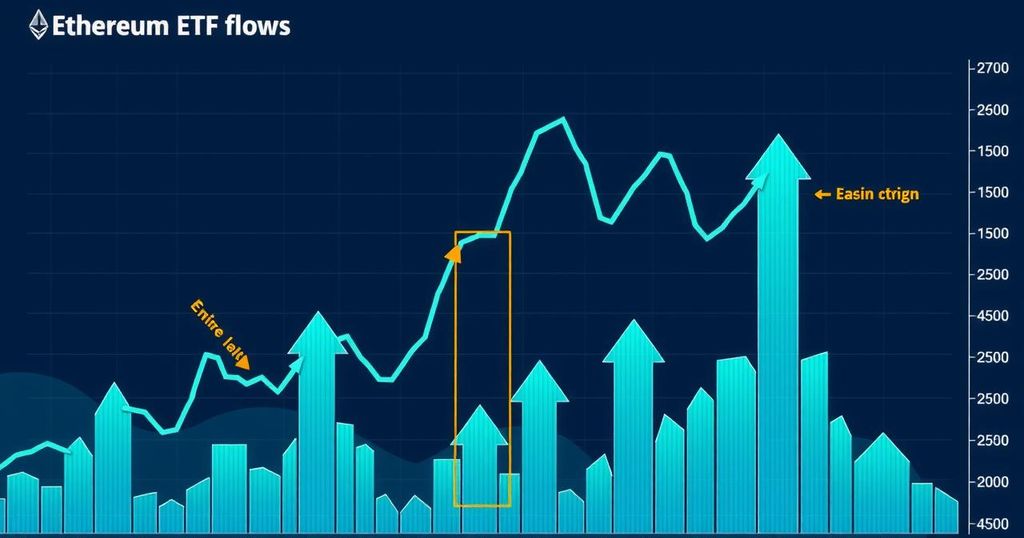

Ethereum ETFs have had a rough couple of days despite a general recovery in the crypto markets. In fact, these ETFs managed to capture only one day of positive inflows in the last three days. On April 22, just $38.8 million flowed into Ethereum ETFs, a stark contrast to the larger market’s uptick, which raises concerns about Ethereum’s performance.

However, this small influx was short-lived; by the next day, about $23.9 million exited the ETFs, extending a trend of negative flows observed over the past two weeks. In terms of comparison, Bitcoin ETFs saw an incredible $2.2 billion in inflows from Monday to Wednesday, indicating a solid demand from institutional investors, while Ethereum saw a disappointing net outflow of $10.5 million over the same period.

The weak performance of Ethereum ETFs is concerning, as it suggests a lack of interest from institutional investors. This trend isn’t entirely surprising given that Ethereum has struggled compared to Bitcoin and Solana. Nevertheless, despite Ethereum’s price bounce back—climbing 32.6% from its low of $1,383 to a recent high of $1,835—this recovery could be stunted by the waning institutional demand. Indeed, without a notable increase in institutional interest, long-term recovery for ETH seems challenging.

When it comes to network performance, Ethereum remains a leading blockchain in terms of utility. This strong network performance likely underpins some ongoing demand. Starting the week, ETH exchange flows increased, but they quickly reversed after April 22, showing the volatility of market sentiment. Exchange inflows surged, outpacing outflows, contributing to a profit-taking phase.

ETH exchange reserves also tell a story; these reserves rose since earlier this month, bouncing from about 19.88 million ETH to around 19.60 million. These reserves are now forming a wedge pattern, indicating potential future price movements. Should prices start retracing again, ETH reserves may test their descending resistance, which could initiate fresh demand.

Additionally, long-term holders appear to be accumulating as they added over 640,000 ETH in the last 48 hours, which equates to more than $1.1 billion in liquidity. While this accumulation boosts ETH’s short-term price, it also raises questions about the future trends of these reserves and the return of Ethereum ETFs. With all these factors at play, the crypto community is left pondering the potential outcomes as the market evolves.

Post Comment