Hedera Price Approaches $0.20: Breakout or Bearish Trap?

Hedera is seeing a price spike towards $0.20, a historically significant resistance level. Traders are questioning if this is a real bullish breakout or a trap. Key indicators suggest caution due to low volume and a prevailing bearish trend. The market is closely watching whether it can break through resistance or fall back to $0.12.

Hedera’s recent surge in price has stirred up quite the buzz in the cryptocurrency world, with HBAR pushing towards the $0.20 mark. This level is historically significant, having acted as a ceiling in previous market activities. Now, traders are left questioning if this rally indicates a real bullish turnaround or merely a trap for the unwary. The anticipation is palpable, but caution is clearly advised here.

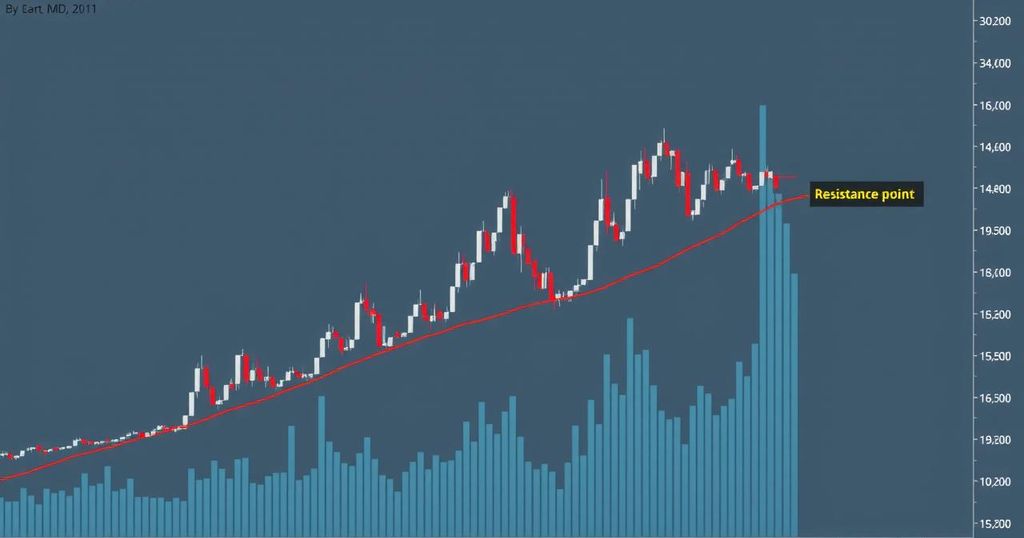

The technical indicators show familiar resistance ahead, and that raises some eyebrows. The current climb comes just as Hedera approaches that trouble spot where it experienced a downturn before. Sounds like history might be ready to repeat itself unless Hedera breaks through this resistance convincingly and with substantial trading volume.

One major red flag is the low volume accompanying this price move. Typically, solid rallies are backed by strong trading activity, and right now, buyers seem uncertain. The HBAR volume appears less than lacklustre, leading many to doubt the sustainability of this breakout attempt.

Although there’s been some excitement about Hedera’s performance lately, we shouldn’t overlook that it’s still trending down on higher time frames. We are seeing lower highs and lower lows, a traditional bearish pattern at work. Last time the price hit this resistance, there was a sharp reversal, and traders have good reason to be apprehensive as they eye the current movement towards that same territory in the charts.

At this point, Hedera is, indeed, testing that pivotal $0.20 zone. The question looms: can it break free, or will it remain constrained? If it isn’t able to pin down a solid close above that mark, many traders are expecting a slip back to around $0.12, further strengthening the downtrend that’s been a feature of the market for some time now.

Now, there is always the chance that Hedera could buck the trend, especially if trading volume ramps up significantly. Should it manage to hold above that critical resistance with strong closes, we might just be looking at the beginnings of a real breakout. This scenario could reinvigorate sentiment and lure in some sidelined investors, but until such changes materialize, caution is the name of the game.

In short, the recent uptick in HBAR price is exciting, but the overall technical landscape is telling a more cautious story. As it revisits that key $0.20 resistance, unless we see a dramatic increase in volume and signs of a breakout, this surge could be more flash than substance. Traders are tipsy at this threshold, monitoring Hedera closely over the coming sessions to decode whether this is a genuine breakout or just a trap in the bearish structure that’s been playing out. The stakes remain high.

Post Comment