Bitcoin Search Volume Dips: Insights from Bitwise CEO Hunter Horsley

Despite Bitcoin’s price remaining high at about $90,000, Google Trends indicates a sharp drop in search volume for Bitcoin. Bitwise CEO Hunter Horsley highlights that this trend reflects a shift from retail investor activity to institutional forces leading the market. While retail interest hasn’t vanished, it has transitioned into institutional-grade products. Additionally, as Bitcoin matures, changes in information-seeking behaviours may also play a role in reduced searches.

Bitcoin’s search volume on Google has long acted as a barometer for public interest in the cryptocurrency. Traditionally, surges in searches often lined up with rising Bitcoin prices. Recently, however, Hunter Horsley, CEO of Bitwise, has noted a surprising trend: despite Bitcoin’s price staying robust at around $90,000, search volume for the term “Bitcoin” has significantly dipped. This disconnect raises several questions about market dynamics.

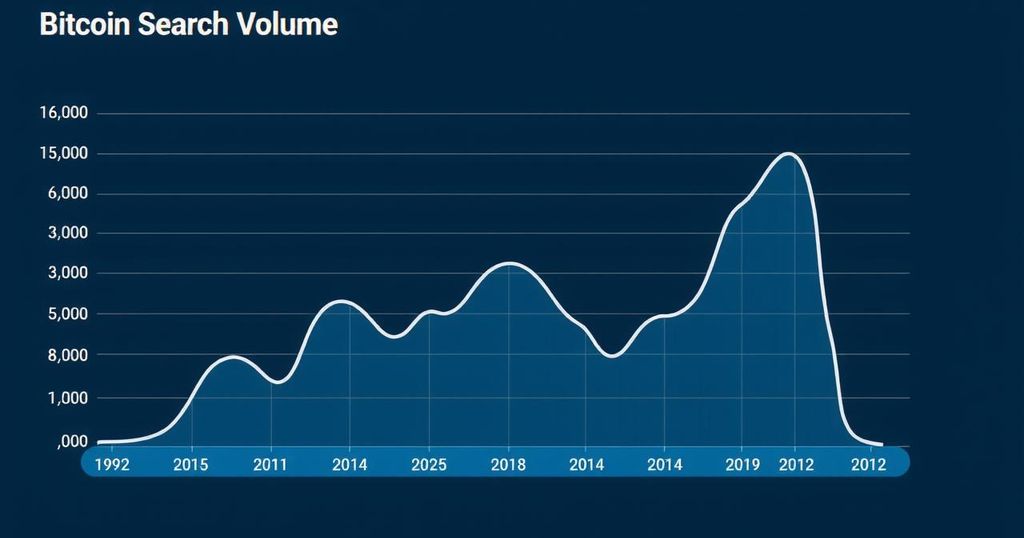

Data from Google Trends illustrates that the search volume for Bitcoin has plummeted in comparison to previous highs, sinking from approximately 75 points to about 25 points over the year. It appears there’s no immediate recovery in sight. The graphical representation from Google shows that interest has gradually decreased since spikes during the cryptocurrency bull runs of 2017 and 2021, settling now at a persistently low level.

Interestingly, while Bitcoin’s price in 2025 has skyrocketed—up by 380% from its 2017 peak and 38% from the 2021 high—Horsley suspects this price increase is not due to a retail frenzy. Instead, he argues that institutional investors are primarily driving the current market rally. “Bitcoin’s at $94,000, yet Google’s search interest for ‘Bitcoin’ is at long-term lows. This is not driven by retail. We are seeing institutions, advisors, corporations, and even nations making their move in this space,” Horsley commented.

Investor diversity in Bitcoin is significantly growing, indicating a maturation phase of the cryptocurrency market. While it may seem that retail investors are absent, they’re actually involved through institutional investment products. Heavyweights like BlackRock, Fidelity, and ARK Invest have entered the market with Bitcoin ETFs, pulling in huge capital flows that have origins in retail investment through institutional pathways.

One investor on social media platform X remarked, “Retail is certainly in, but not in the traditional spot market. When analysts mention big institutions like BlackRock and Fidelity, we should not overlook the retail dollars backing those purchases.” Recently, Fidelity revealed that public companies added nearly 350,000 BTC shortly after the US elections, averaging over 30,000 BTC purchases monthly this year. Meanwhile, ARK Invest suggests Bitcoin could hit a staggering $2.4 million by 2030, buoyed by ongoing institutional adoption.

Beyond these institutional influences, several additional aspects could account for the drop in Bitcoin search interest. First off, it’s worth noting that Bitcoin is no longer cutting-edge. After over a decade, those who are keen on crypto generally already have a grip on the basics, reducing the frequency of their online searches for information.

Secondly, changes in how people seek out information matter too. Increasingly, users are opting for AI tools or social media platforms like X for updates. This shift could be steering them away from traditional search engines.

In summary, while Bitcoin may command a high price and institutional interest is robust, the low search volume suggests a transformed landscape in how and why investors engage with the market.

Post Comment