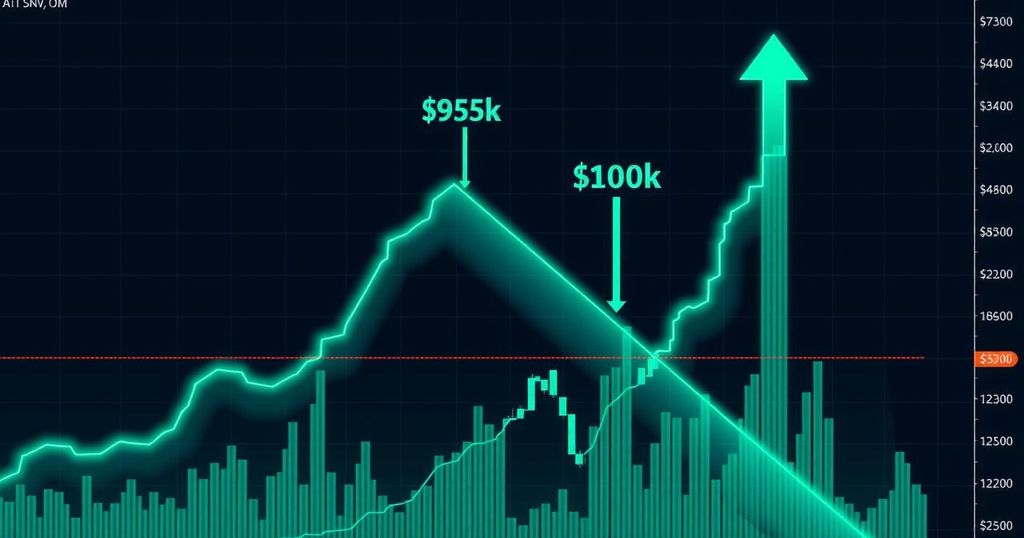

Bitcoin Consolidates Near $95K with Eyes on $100K Potential

Bitcoin (BTC) is consolidating near $95K as it shows bullish momentum. An ascending triangle pattern signals a possible breakout, particularly if it exceeds the $95.3K mark, leading towards $100K. Conversely, a drop below $92.7K could trigger a pullback. With a trading volume increase and market cap at $1.88 trillion, traders are watching the developments closely for potential volatility.

Bitcoin (BTC) is currently showing signs of consolidation, hovering around the $95,000 mark and drawing attention from traders. The cryptocurrency is priced at $94,858 with a trading volume that has spiked nearly 10% in the last 24 hours, reaching $27.59 billion. The total market cap stands at about $1.88 trillion. This solid performance indicates bullish momentum as the market gears up for a potential breakout.

Looking at the charts, Bitcoin is stuck within a four-day range, which often indicates a pause before something big happens. Even though there’s not much price movement right now, this period of consolidation can be a precursor to increased volatility. The combination of stable trading volumes and bullish signals suggests that traders should pay close attention to what unfolds next.

On the 4-hour chart, an ascending triangle pattern is forming, typically a sign that bullish momentum is taking hold. This pattern highlights that demand is increasing, with buyers pushing prices to higher lows and approaching a key resistance level. The $.300 mark, specifically $95,300, is crucial right now. A breakout above that level could trigger a significant move towards the psychologically and historically significant $100,000 liquidity area.

However, traders should keep in mind that not everything is rosy. If Bitcoin fails to break through resistance, the risk is real. A drop below $92,700 would invalidate the current bullish setup and could lead to a retreat back to the Fair Value Gap (FVG) on the chart. This scenario might present a buying opportunity for those looking to enter before a new upward trend takes hold.

As Bitcoin fluctuates just beneath resistance, it’s imperative for traders to exercise patience. The market is essentially at a standstill, anticipating a confirmation of its direction. Whether Bitcoin breaks out or falls back could dictate the next significant shift in the market’s trajectory. Now, it’s just a waiting game to see how this plays out.

In summary, while there’s a strong bullish sentiment surrounding Bitcoin, it’s essential not to overlook the potential pitfalls that might emerge. Traders must stay vigilant and prepared for whatever comes next in this ever-evolving market.

Post Comment