Bitcoin Price Forecast: Sixfold Increase to $351,046 by 2025?

A new analysis suggests Bitcoin could reach $351,046 by 2025, based on historical patterns linking price to Bitcoin’s age. Notably, projections show a consistent sixfold price increase for each 40% age rise. Anomalies in past performance raise questions about external influences, but the overall trend appears resilient. Additionally, traders eye crucial support levels amid optimistic price targets of up to $125,000.

Recent analysis out of 21st Capital has put forth an intriguing projection concerning Bitcoin’s future price trajectory. The study highlights that historically, Bitcoin’s price has increased sixfold each time its effective age grows by 40%. If this trend were to continue, projections suggest that BTC could soar to an eye-watering $351,046 by 2025.

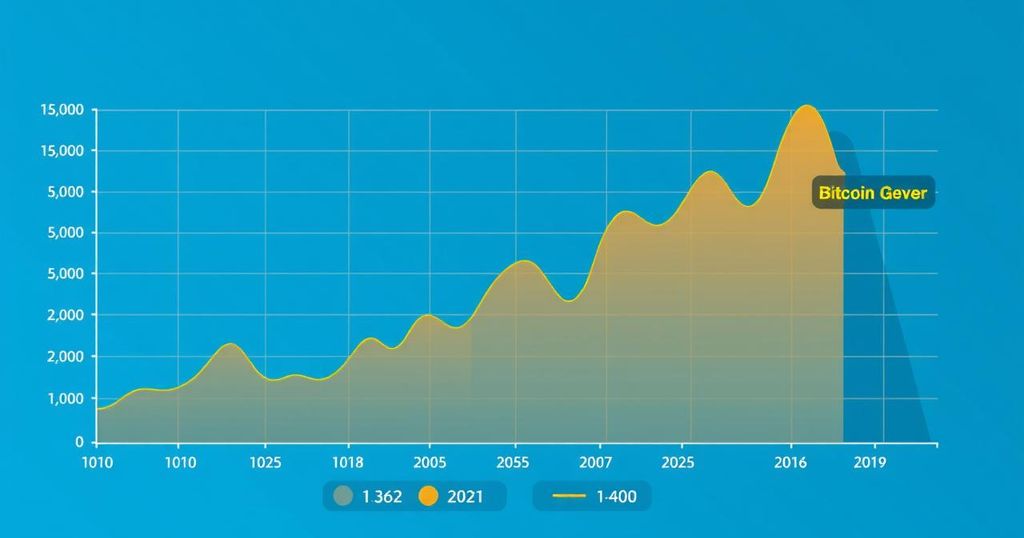

The findings utilise a logarithmic chart, tracing Bitcoin’s price movements since 2011. Sina, 21st Capital’s co-founder, provides insight, noting that the log-log graph depicts a linear relationship that showcases a long-term growth driven by concepts associated with network dynamics and Bitcoin’s inherently limited supply.

Delving into the mathematics behind this price forecast, it hinges upon the length of time Bitcoin has existed. According to this model, for every 40% increase in Bitcoin’s age, a sixfold price multiplier is applied. For example, from ages 8.83 to 12.83 years—2017’s peak at $19,666 to 2021’s peak at $68,000—an overall age increase of about 45% resulted in a price multiplier of approximately 3.4, which feels like a hiccup against the supposed model.

If the trend continues, Bitcoin’s predicted price of $351,046 by the age of 16.33 years in 2025 represents a 5.2 times bump from its 2021 level. This pattern, described as a power law, suggests that Bitcoin’s appreciation parallels developments in its network maturity rather than aligning strictly with the calendar.

Interestingly, historical peaks often occurred prior to significant age increases. When comparing the model’s projections against actual Bitcoin price data, evident discrepancies emerge—especially during earlier years before 2017 and the recent peaks of 2023, where the model predicted $139,968 but saw the asset trading closer to $42,258.

Various external influences might have caused these irregularities. Major market events, such as the 30% crash during the 2021 sell-off, regulatory changes like China’s crypto ban in 2021, and the impact of rising interest rates have all put a dent into Bitcoin’s trajectory, linking it more closely to overall investment risk tolerance.

Nonetheless, the model shows surprising resilience even amid the tumult of regulatory woes, market volatility, and broader economic pressures. It successfully encapsulates Bitcoin’s overarching upward trend through non-linear graphical representations.

In related news, an anonymous analyst known as blackwidow has identified a fractal pattern suggesting that support for Bitcoin in 2024 at $58,000 mirrors a potential setup for 2025 at $84,000. On social media platform X, the analyst pointed out the importance of the $84,000 level as it coincides with areas of heavy trading volume, making it an attractive re-entry point for traders looking at potential bullish momentum.

Further echoes of this optimism come from crypto trader Titan of Crypto, hinting that Bitcoin’s future looks promising with targets set at $125,000—a figure derived from the Golden Ratio Multiplier’s charts. Observations suggest that Bitcoin’s recent price move off a significant chart level indicates the digital asset is gearing up for new highs.

As always, it’s essential to underline that all investments carry risks. This article should not be considered financial advice, and individuals should conduct their own due diligence before making any trading decisions.

Post Comment