Bitcoin Funding Rate Plummets on Binance: Implications for Price Movement

Bitcoin’s price is showing potential recovery as it nears $98,000, aiming for $100,000. A significant decline in funding rates on Binance indicates bearish market sentiment, caused primarily by retail trader selling. On-chain analysis suggests that extreme negative funding rates could lead to a short squeeze, possibly pushing prices higher. Currently, Bitcoin sits at about $96,950, reflecting a 2% price increase in 24 hours, with potential for further gains this weekend.

Bitcoin has seen varied activity as April drew to a close, transitioning into May with renewed energy. Recently, the cryptocurrency has made a strong comeback, nearing $98,000, and is eyeing the pivotal $100,000 milestone as the weekend approaches.

Since briefly crossing the $100,000 threshold in early February, Bitcoin (BTC) has floundered under that figure, barely making any significant upward movement for about three months. However, fresh on-chain data hints that the quest to reclaim that six-figure valuation may be on the horizon, with some observers suggesting that a bullish resurgence could be imminent.

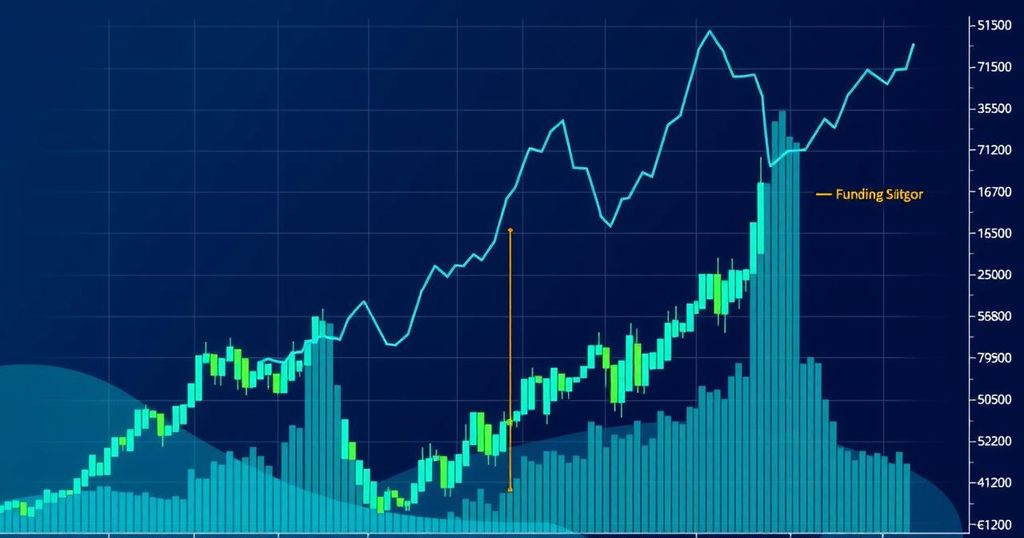

So what does a negative funding rate signify for Bitcoin’s price? Recently, on the CryptoQuant platform, analyst Amr Taha shared insights indicating that the Bitcoin funding rates on Binance have plunged significantly in just a few days. This funding rate essentially represents the periodic fees exchanges between long traders—who hold buy positions—and short traders—who take sell positions—in the derivatives market.

When this rate is positive, it usually means long traders are paying fees to shorts, signalling a bullish attitude in the market. Conversely, a negative funding rate means those with short positions are compensating long traders, which reflects prevailing bearish sentiment. This could point to trouble for those betting against Bitcoin’s value.

As per CryptoQuant’s recent data, Bitcoin’s funding rate on Binance, which is the largest crypto exchange by trading volume, has dipped severely, sitting around -0.0008%. This shift illustrates a notable change in market dynamics and sentiment amongst traders.

Taha’s analysis suggests that this declining funding rate can be traced back to significant selling activity among retail Bitcoin traders. However, this fear-driven selling is not seen as indicative of fundamental weaknesses within Bitcoin; rather, it’s more about market sentiment at the moment.

Interestingly, Taha also pointed out that deep negative funding rates often precede a short squeeze, where short traders must seek to cover their positions, potentially leading to price increases. Historically, such low funding rates have coincided with local price bottoms preceding bullish reversals.

As things stand, Bitcoin’s price hovers around $96,950, marking a 2% increase over the last 24 hours. If the recent surge in prices combined with the new on-chain data is anything to consider, Bitcoin may well be on track to surpass the $100,000 mark this weekend.

BTC’s daily chart on TradingView shows a pattern that may be developing, hinting at potential further bullish activity. Overall, investors should keep an eye on these movements and market updates in the coming days, as every twist in sentiment could have far-reaching impacts on BTC’s trajectory.

Post Comment