Ethereum Price Drops While Trading Volume Rises Amid Market Shifts

Ethereum’s price falls to $1,805.90, down 1.10% in 24 hours, despite a 6.68% increase in trading volume. Market capitalisation at $218 billion as traders reposition. Top gainers include XDC Network and Pudgy Penguins; Raydium, Ethena, and Flare are the biggest losers. Broader market trends highlight impacts of macroeconomic factors, security breaches, and halving events on the crypto landscape.

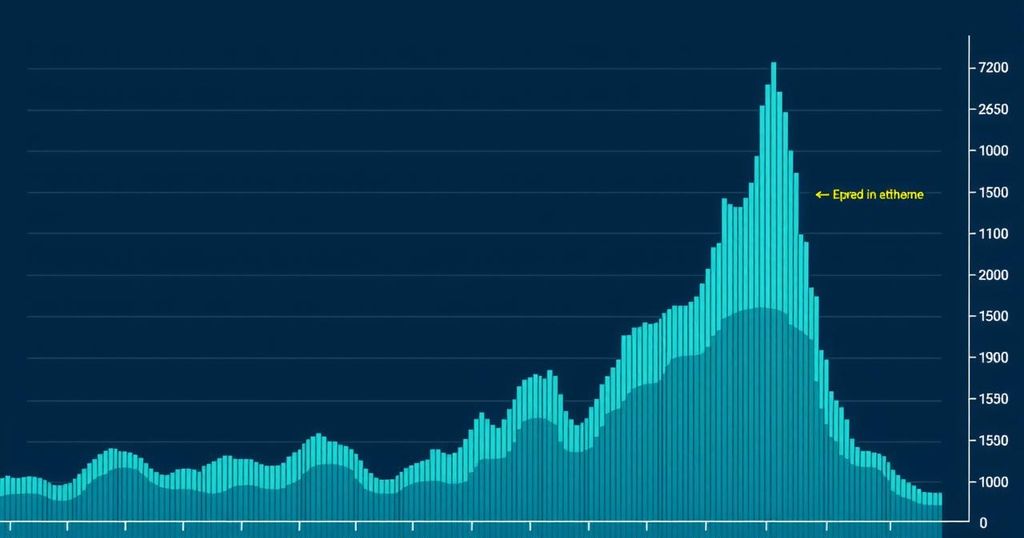

Ethereum’s price recently took a hit, dropping to $1,805.90 from $1,825.94, marking a 1.10% decline within a 24-hour span. Interestingly, trading volume saw a rise of 6.68%, reaching over $10.84 billion. This contrast between falling prices and increased trading volumes often suggests that traders are either cashing out profits or realigning their positions ahead of Ethereum’s next potential price movement.

Over the past week, Ethereum’s value has seen a slight uptick of 0.86%, while its total market cap stands at approximately $218 billion. In recent market activity, four notable gainers emerged: XDC Network and Pudgy Penguins topped the list, while Raydium, Ethena, and Flare experienced declines, making them the top market losers.

In the broader context, various factors impact cryptocurrency prices. For instance, new token launches can positively influence demand and adoption as they enhance liquidity and attract new investors to the ecosystem. Alternatively, security breaches, such as hacks where attackers exploit vulnerabilities to steal assets, can incite panic selling and subsequent declines in affected cryptocurrencies.

Economic events play a major role too. For instance, decisions from the US Federal Reserve regarding interest rates deeply influence crypto markets, primarily through their effect on the US Dollar. A hike in interest rates often sees negative repercussions for prices of Bitcoin and altcoins, while a dip in the US Dollar can make risk assets more attractive, potentially boosting crypto prices.

Halving events are often viewed as bullish since they reduce the rewards for miners by half, effectively tightening supply. If demand remains steady amidst this decreasing supply, prices tend to rise.

It’s crucial to remember that the information provided here comes with uncertainties and risks attached. While this information is designed for informational purposes, it’s not a recommendation to buy or sell any assets. Conducting thorough personal research is essential before making any financial commitments.

The author has no current stake in the stocks mentioned and has not been compensated for this writing, with no business affiliations to disclose. FXStreet and the author do not offer personalised investment counsel and are not registered investment advisors. Thus, they’re not liable for any errors, omissions, or resultant damages from using the provided information.

Meanwhile, elsewhere in the cryptocurrency world, the overall market remains in a consolidation phase, particularly with Bitcoin holding above $94,000. Yet, specific AI tokens such as Bittensor, Akash Network, and Saros show stability despite this larger trend.

Cardano (ADA) has been seeing bearish momentum, with its price around $0.650 after a significant drop in recent days. On-chain indicators paint a negative picture, showing declining network activity and negative funding rates.

Solana (SOL), on the other hand, is trading above $145 because of the DeFi Development Corporation’s plans to acquire a validator for $3.5 million, allowing it to self-stake and reap staking rewards directly.

In another development, Bernstein predicts that corporate treasuries could direct $330 billion into Bitcoin by 2029. This suggests a growing trend among firms adopting Bitcoin treasury strategies, which smaller companies may soon follow.

Lastly, Bitcoin is making headlines as it stands at about $97,000, hinting at a potential climb back to the $100K mark after logging four weeks of consecutive gains.

For traders interested in Forex, further details on leading brokers for trading EUR/USD for 2025 are available, highlighting those with favourable execution speeds and competitive spreads, suitable for both novices and seasoned traders.

Post Comment