Bitcoin

Legal stuff

AXIOS, BITCOIN, BTC - E, CFTC, COMMODITY FUTURES TRADING COMMISSION, CRYPTOCURRENCY, FINANCE, FINCEN, FOOD FOR THOUGHT, HOUSE OF REPRESENTATIVES, NEW YORK, NORTH AMERICA, REGULATION, REGULATORY COMPLIANCE, RIPPLE, SEC, SECURITIES AND EXCHANGE COMMISSION, U. S, UNITED STATES, US, WYOMING, YORK

Marcus Collins

0 Comments

New US Legislative Proposal Aims to Establish Crypto Regulatory Framework

US lawmakers have proposed a bill for clearer cryptocurrency regulations, aiming to classify digital assets under existing frameworks. The bill addresses the long-standing regulatory fragmentation, distinctively categorising payment stablecoins and imposing rules for exchanges. Advocates believe it will balance innovation with investor protection amid increasing global competition in crypto regulation.

US lawmakers are once again stepping into the world of cryptocurrency regulation. Members of the House of Representatives recently introduced a draft bill intended to establish a more coherent regulatory framework for digital assets in the United States. This 212-page proposal was unveiled on May 5, 2025, and seeks to clarify how cryptocurrencies will be classified and managed under existing legal structures.

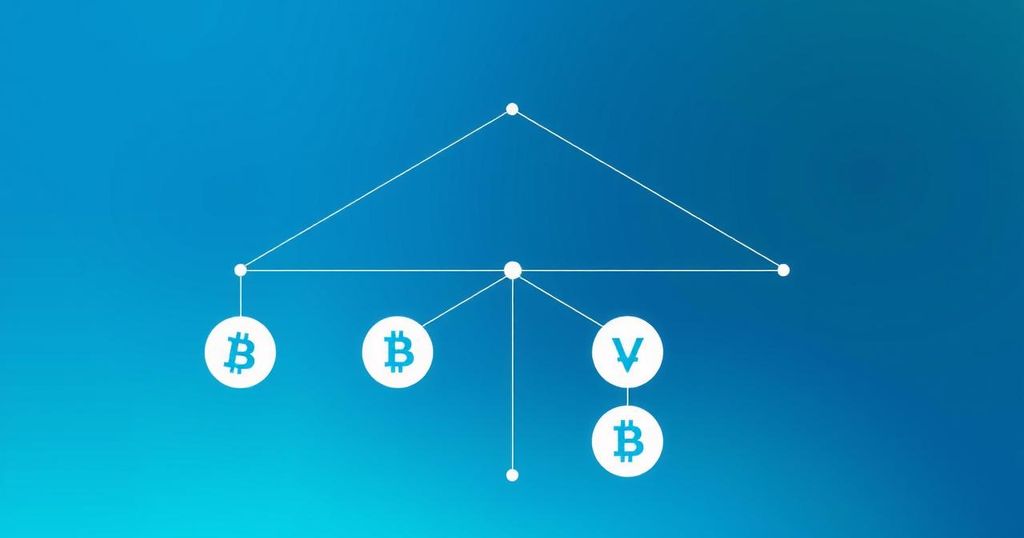

The bill proposes detailed criteria for determining whether digital assets would fall under the purview of either the Commodity Futures Trading Commission (CFTC) or the Securities and Exchange Commission (SEC). It actively engages the long-standing debate surrounding the classification of these assets, offering rules on how they may be reclassified over time. Notably, payment stablecoins are carved out as a distinct category, separating them from existing asset classifications, which could have major implications for their regulatory treatment.

As the bill progresses, it also imposes regulations on cryptocurrency exchanges and secondary trading markets, requiring compliance with the Bank Secrecy Act — an important piece of legislation aimed at combating money laundering. Furthermore, issuers of new assets are expected to provide specific disclosures to regulators, while developers and infrastructure providers are likely to see certain exemptions designed to encourage innovation within the sector. Supporters of the bill argue that well-defined rules could strike a balance between fostering innovation within the crypto space and providing essential protections for investors.

The issue of regulatory fragmentation in U.S. crypto regulation is a chronic one that has lingered for over a decade. Since at least 2011, when the Financial Crimes Enforcement Network (FinCEN) first revised its definition of money service businesses to include virtual currencies, the regulatory approach has been anything but cohesive. Different government agencies have applied existing frameworks to cryptocurrencies, resulting in murky jurisdictional boundaries — the SEC has treated many tokens as securities, while the CFTC has deemed Bitcoin a commodity.

Due to this lack of federal guidance, states have taken it upon themselves to fill the void, creating their own regulations — a patchwork that includes New York’s BitLicense and Wyoming’s more crypto-friendly laws. The consequences of this uncertainty were evident in the hefty fines levied against cryptocurrency platforms like Ripple and BTC-e for regulatory noncompliance, highlighting the urgent need for a unified framework that this bipartisan effort aims to provide.

Central to this new proposal is the question of whether digital assets should be classified as securities or commodities. This has been a contentious issue in the regulatory field. Legal battles, particularly the SEC’s tussle with Ripple, underscore the industry’s fight for clarity. A key outcome of that case held that XRP sales on exchanges weren’t classified as securities offerings — a small win for crypto enthusiasts. The bill aims to facilitate a pathway for assets to “graduate” to commodities status as they become more decentralized, aligning with the argument that decentralised networks don’t fit neatly into traditional frameworks.

This progress aligns with the global context where other regions have acted more swiftly and decisively regarding cryptocurrency regulations. The European Union’s rollout of the Markets in Crypto-Assets Regulation (MiCA) has created a unified regulatory structure that other jurisdictions may look to replicate. Countries such as Japan and Switzerland have recognised cryptocurrencies as legal property, offering clear operational pathways that result in dynamic blockchain ecosystems.

Currently, up to 33 out of 60 countries studied have fully legalised cryptocurrencies, including a dozen from the G20. This reflects a shift toward regulatory acceptance rather than repression. The new U.S. legislation seems aimed at striking the right balance between fostering innovation and ensuring consumer safety, similar to approaches taken in Australia, where crypto assets are classified as legal property subject to capital gains tax and anti-money laundering laws.

Post Comment