Bitcoin Faces Challenges as Investor Demand and Whale Activity Declines

US investor interest in Bitcoin is decreasing, with major holders selling off assets. The Coinbase Premium has turned negative, indicating reduced whale buying activity. Notably, KuCoin reported a significant decrease in BTC reserves after KYC announcements, which may affect market liquidity. Technical indicators suggest caution as BTC prices fluctuate between key levels while anticipating the upcoming FOMC meeting.

Bitcoin’s Recent Weakness Amid Changing Investor Landscape

Bitcoin isn’t having the best of times lately. Interest from U.S. investors appears to be dwindling as major holders begin to pull back their positions, taking the wind out of Bitcoin’s sails. Moreover, the Coinbase Premium, which gauges the price difference between Bitcoin on Coinbase and other global exchanges, has flipped into negative territory. This dip indicates that the buying pressure from U.S. whales is subsiding, while large outflows from exchanges like KuCoin call for more caution.

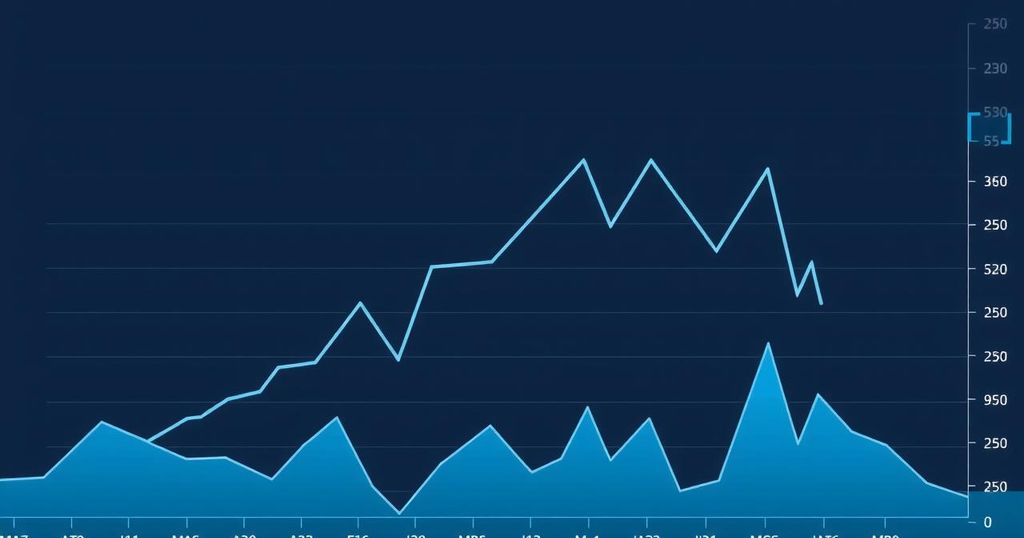

Taking a closer look at the Coinbase Premium, it’s dropped to around $5.07, having previously swung between highs and lows in recent weeks. It had even bounced from a staggering negative of around -$125 back in March to over $50 by April’s mid-point. But its recent negative shift speaks volumes—whales seem to be more inclined to sell now than buy, with the current BTC price facing downward pressure as it fell from just above $97,000 to roughly $94,000 within a short span.

Whale activities are painting a somewhat bearish picture too. Arkham’s latest figures show a whale with an eye-popping $800 million in Bitcoin recently moved $2.8 million in BTC, marking its first transaction in two months. The funds got sent to an address often associated with transferring Bitcoin to Binance, hinting at possible selling intentions. This behaviour is a typical sign of profit-taking, especially considering Bitcoin’s surge from under $75,000 since early April.

Traders are starting to wonder if more long-term holders are looking to cash in their profits, given the significant rise in Bitcoin’s price. Although the dollar amount moved is small compared to the whale’s total, its timing alongside a bearish crossover of Bitcoin’s daily MACD raises eyebrows. Traders often interpret such crossovers as markers of potential downtrends ahead.

In addition, data from CryptoQuant reveals that KuCoin’s BTC reserves plunged a staggering 77.6% since June 2023, following announcements regarding new Know Your Customer (KYC) regulations. The reserve dropped from 18,300 BTC to about 4,100 BTC—a net loss of around 14,200 BTC. This mass exit from the exchange may hint at traders moving their bitcoin elsewhere amid rising regulatory concerns, which could drastically impact market liquidity.

Sure, a drop in exchange reserves might lessen immediate selling pressure, but it could also mean less trading activity if traders choose to hold onto their Bitcoin instead of moving it around. Oddly enough, even with KuCoin’s massive outflows, Bitcoin’s price has shown resilience, though it raises the question: what happens if other exchanges face similar outflows or confidence takes a hit?

Technical indicators are leaning towards caution as well. Currently, Bitcoin seems to be range-bound between $96,000 and $92,000, sitting around $94,100 at the moment. Scanning through charts reveals the daily MACD lines have crossed downwards—another red flag signaling bearish conditions for traders. Should the price keep sliding, a revisit to the Fair Value Gap (FVG) area, possibly around $88,000 to $90,000, could be on the horizon.

All eyes are also on the Federal Open Market Committee (FOMC) meeting coming up, with traders eagerly awaiting insights from Jerome Powell. Given Bitcoin’s classification as a risk asset, decisions emanating from the Fed will likely influence its market behaviour. If the outlook hints at sustained high rates, we may see further downward pressure on Bitcoin’s already softening price.

Disclaimer: This article intends for informational use only and should not be construed as financial or investment advice. Action taken based on this article is done at your own risk. Always perform your own due diligence before making any financial decisions.

Post Comment