Bitcoin Price Analysis: Signs of Weakness After New All-Time High

Bitcoin recently reached a high of $112K, surpassing its previous record of $109K. Despite initial bullish strength, signs suggest a possible consolidation phase. Technical analysis indicates that support at $109K is critical, with potential corrections if selling pressure increases. Meanwhile, long-term holders appear confident, indicating ongoing accumulation despite recent profit-taking by short-term traders.

Bitcoin, the leading cryptocurrency, recently broke past its previous all-time high, climbing from $109K to an impressive new high of $112K earlier this week. However, while momentum remains somewhat positive, signs indicate that a consolidation period may be on the horizon in the near term, which could affect investor sentiment.

In examining the daily chart, it’s clear that Bitcoin’s breakout to $112K illustrates strong interest from buyers, proving that bullish sentiment is still prevalent. Yet, there’s a noticeable softening in momentum, as Bitcoin experiences a minor pullback back toward the previous high of $109K, which has now formed an essential support level. If buying pressure resurfaces at this threshold, we could see Bitcoin push towards $115K again and potentially higher.

On the flip side, if selling pressure builds and Bitcoin drops below the $109K support line, it might trigger a deeper correction. In such a case, a retest of the psychological $100K mark could become very likely. This scenario would not only cast doubt on the current bullish breakout but might also introduce more volatility in the days to come.

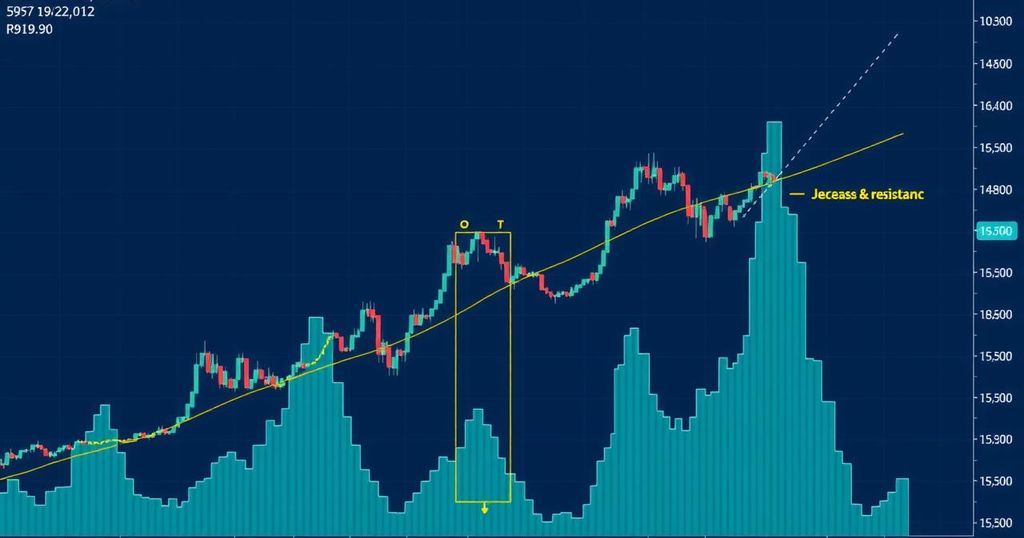

Looking at the 4-hour chart, Bitcoin’s trajectory shows a bullish structure that’s respected by a sequence of higher highs and lows. It’s been adhering to an ascending trendline, which acts as a key support area. Bitcoin is now retracing towards this trendline while also flirting with the previous swing high of $109K. This convergence is critical; if it holds strong, we might see another surge towards the $115K resistance level but any break beneath the trendline would indicate some short-term weakness and possibly open the path back to $100K.

According to ShayanMarkets’ on-chain analysis, profit-taking from traders following Bitcoin’s rise to $112K was expected. But the behaviour of long-term holders, or those who have maintained their BTC investments for over 150 days, tells a different story. Notably, the Long-Term Holder Spent Output Profit Ratio (LTH-SOPR) remains low compared to patterns observed when Bitcoin climbed to $73K in late 2024. This suggests that long-term investors are not eager to cash out, indicating potential ongoing accumulation and confidence in future price increases.

This discrepancy in trading behaviours reinforces the idea that the current market phase is being influenced mostly by short-term traders and retail investors, rather than widespread distribution. If long-term holders continue to display strong commitment, Bitcoin may have what it takes to resume its upward trend following this short-term plateau, perhaps leading to new all-time highs in the future.

Post Comment