Ethereum Indicator Signals Market Bottom Before Recent Rally

A recent analysis by Glassnode highlights vital Ethereum metrics indicating market bottom trends ahead of a significant rally, offering investors critical insights during crucial trading moments.

Key Indicator Reveals Insights on Market Movements

Ethereum’s recent rally comes on the back of an interesting metric identified by on-chain analytics firm Glassnode. The firm has articulated an intriguing correlation between the ‘Net Unrealized Profit/Loss’ (NUPL) indicator and the timing of market movements. Specifically, this metric is said to have pointed out the bottom of Ethereum’s price well ahead of the current upswing, aiding investors in understanding market dynamics during tumultuous periods.

Understanding the NUPL Indicator

So, what exactly is the NUPL? To put it simply, this metric evaluates the net profit or loss of all Ethereum investors. It digs into transaction histories of coins on the Ethereum network, assessing at what value tokens were last moved. If a token was previously sold at a higher price than its current market value, it’s classified as in a state of net unrealized loss; conversely, if a token is now worth more than the last price it was transferred at, it signifies profit. This financial dance reveals a bigger picture regarding the emotional state of investors.

Market Sentiment Flips with Price Changes

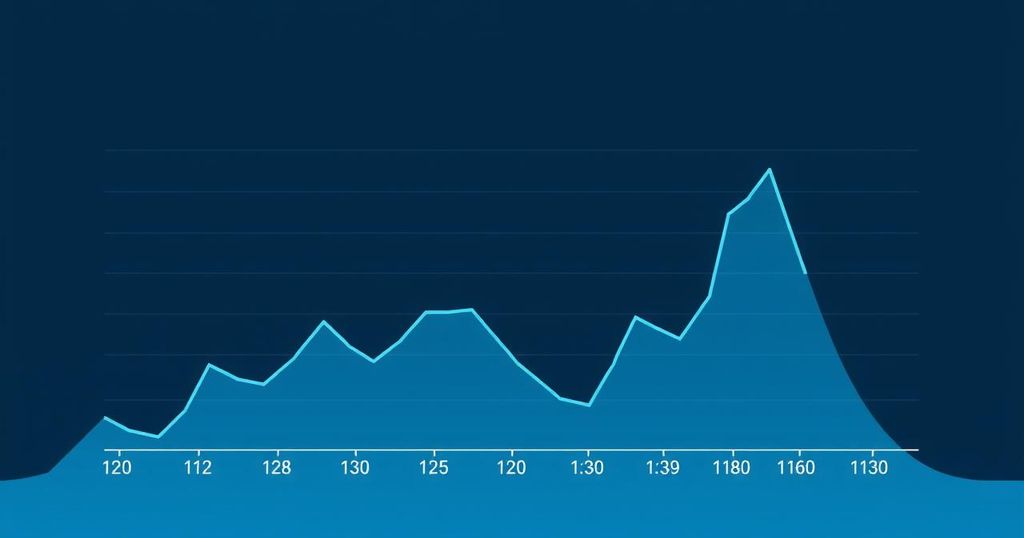

Glassnode tweeted that when the NUPL indicator stands at a positive value, it reflects that overall, investors are seeing net unrealized profits. However, when it dips below zero, it indicates widespread losses. In recent months, the Ethereum NUPL fell to approximately -0.2, highlighting that numerous investors were caught in a net loss, a sign that often suggests capitulation. Glassnode’s methodology flags such instances, indicating a significant downward trend in market sentiment that could foreshadow an impending turnaround.

Recovering Sentiment Among Investors

Utilising historical data, the correlation becomes clearer. The drop in the Ethereum NUPL into the capitulation zone could very well have acted as a signal for investors to anticipate potential market shift. It’s often observed in crypto that prices rebound at levels least expected, and this seems to have rung true in this instance. As Ethereum’s value surged post-drop, investor sentiment began to recover, showing signs of renewed optimism following a troubling low period.

Ethereum’s Price Surge and Future Considerations

The recent rise in Ethereum’s price has proven significant, with the cryptocurrency climbing over 20% just this past week, soaring to around $3,600. Its separation from Bitcoin’s market movements has drawn attention, suggesting an engaged interest from various investor sectors. There’s a positive implication that institutional demand is rushing in, which could further solidify Ethereum’s position in the market. However, as optimism grows, it’s worth keeping an eye on the NUPL metric; if profits considerably outweigh losses, it’s possible that we might see some shifts back toward bearish tendencies in the near future.

In summary, Glassnode’s metric has highlighted pivotal moments in Ethereum’s pricing patterns, specifically signifying price bottoms through its NUPL indicator. As Ethereum’s rally unfolds, a cautious watch on investor sentiment shifts is necessary. Understanding these signals may help to navigate the crypto market more effectively in the future.

Post Comment