Bitcoin Price Rallies: Key Patterns That Signal 50% Gains

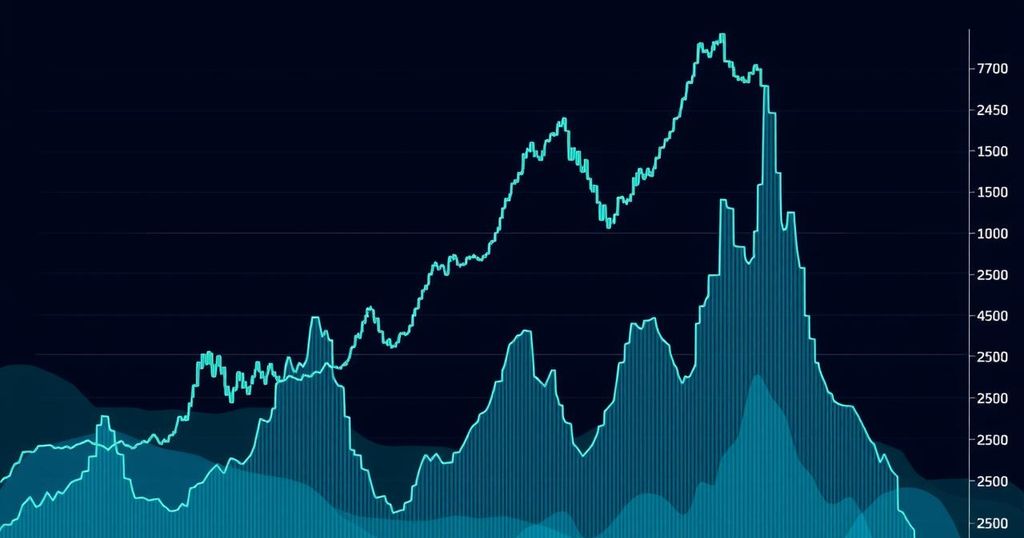

Bitcoin price rallies significantly—typically by over 50%—when there’s a combination of low leverage in the crypto market, robust retail sales figures, and a shift in Federal Reserve policy expectations. Recent bullish trends saw Bitcoin rise 50% on multiple occasions, with critical upcoming data releases and Fed Chair Jerome Powell’s speeches likely influencing future price movements.

Bitcoin often experiences price rallies exceeding 50% following the confluence of three distinct factors: easing expectations around US Federal Reserve policies, low leverage in the crypto markets, and robust retail sales data. In the past, such alignments led to remarkable gains, which should give investors some food for thought.

To illustrate, in early 2024, as these three scenarios converged, Bitcoin soared from $40,000 to $73,500 in just seven weeks. Comparatively, a similar situation cropped up in early 2023 when Bitcoin climbed from $16,700 to $25,100. Even earlier, between July and September 2021, Bitcoin witnessed a staggering 76% increase. These patterns might hold valuable lessons for current and future market behaviour.

Most recently, Bitcoin’s price lingered around $43,000 in December 2023, only to test $48,000 in January 2024. However, after a failed attempt at that level, the price dipped to $37,800. It was at this moment that Bitcoin began a seven-week upward trend, significantly driven by the perpetual futures funding rate, which was impressively low at just 4% per annum.

Moreover, positive US retail sales data in January 2024 surprised many, edging up by 0.6% month-over-month, far surpassing the projected 0.4%. Adding to the mix, Fed Chair Jerome Powell’s stringent monetary stance during a January press briefing indicated no indication of immediate rate cuts, which further bolstered the bullish sentiment around Bitcoin.

In early 2023, prior to another notable rally, Bitcoin had been stuck below $18,000. The leverage demand was so low that the perpetual futures funding rate was nearly non-existent. Things shifted dramatically on January 3, when rates shot up to 50% within days, coinciding with unexpectedly robust retail sales growth of 3%, blowing past the anticipated 1.9% increase. Furthermore, Powell reiterated a tougher monetary policy during his speech on January 10, which reassured many in the market.

The rally that occurred between July and September 2021 also fits this pattern. Bitcoin plummeted from $40,000 to below $30,000 leading into this period, which left the market quite pessimistic. Yet the funding rate then surged noticeably, going from 0% to 37% shortly, while the US retail sales data defied expectations by rising 0.6%. Moreover, Powell’s remarks at Jackson Hole reiterated future cuts in asset purchases to counteract inflation, stoking optimism among traders.

Overall, a common theme appears: when expectations shift towards less expansionary Federal Reserve policies, and when leverage is low, robust retail data can lead to exponential rallies in Bitcoin. Traders, as we know, often remain on their toes amid economic uncertainty.

With Fed Chair Powell slated to speak on June 18, as well as the upcoming Beige Book release and the Jackson Hole Economic Symposium later in the summer, crucial developments will be closely watched. Additionally, retail sales data due in mid and late June could shape the market’s course. An astute eye on these dates might just be prudent for those wanting to tap into the next Bitcoin opportunity.

Post Comment