Bitcoin Stabilises Amid Trade Talks: Key Insights and Market Dynamics

Bitcoin’s price stabilises around $83,500 as it struggles to break past $85,000 resistance. Trade talks between China and the US may influence market sentiment favourably. Semler Scientific plans to raise $500 million to bolster BTC holdings, hinting at growing corporate interest. CryptoQuant data shows decreased selling from large investors, suggesting a potential shift in market dynamics.

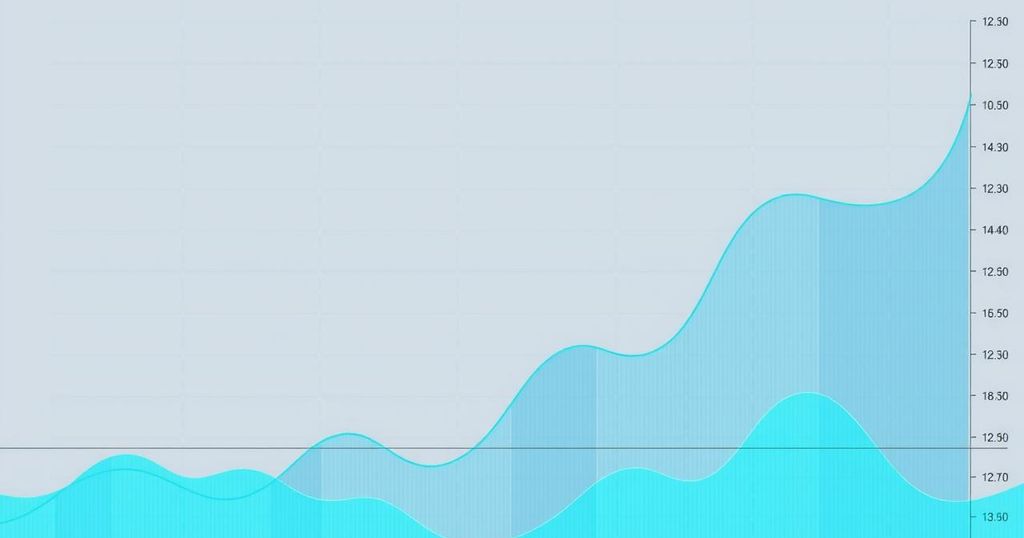

Bitcoin is presently stabilising around $83,500 following unsuccessful attempts to break the 200-day Exponential Moving Average (EMA) resistance at $85,000. According to Bloomberg, China has expressed willingness to engage in trade talks with President Trump’s administration, which may alleviate trade tensions and positively affect Bitcoin’s risk profile.

Recent data from CryptoQuant indicates a reduction in Bitcoin sales from large investors while miner sales have risen. Furthermore, Semler Scientific is set to raise $500 million to increase its Bitcoin holdings, demonstrating a growing corporate interest in Bitcoin as a strategic asset.

The Bloomberg report details that China’s readiness for trade discussions depends on the US moderating critical comments from Trump’s cabinet. This environment could lead to improved sentiment in global markets, reflected by a surge in S&P 500 futures by 100 points following the news.

In a recent SEC filing, Semler Scientific stated their commitment to Bitcoin by seeking funds to further bolster their BTC reserves. With current holdings of 3,192 BTC, their strategy may support increased demand and thus impact Bitcoin’s price positively over time.

CryptoQuant’s report highlights that selling pressure from large investors has diminished, suggesting a shift in market dynamics. Miners, experiencing decreased profitability due to price drops, have increased outflows, signalling caution among market participants. Analytics show a significant outflow spike from miners in response to price dips.

As Bitcoin faces significant resistance at $85,000, traders must observe movement on the Relative Strength Index; a break above this level could indicate bullish trends, whereas continued declines may push Bitcoin towards the support level of $78,258.

In summary, Bitcoin’s market is influenced by broader economic developments, corporate strategies, and trader sentiment, leading to significant reflections in price action. Effective monitoring of these factors will aid in anticipating future movements.

Post Comment