Is South Korea’s Crypto Market Prepared for Institutional Investment?

South Korea’s cryptocurrency market is a significant global player, predominantly retail-driven with a focus on altcoins. Despite recent reductions in trading volumes and a shift in market dynamics, it retains a strong position with 35% of the global share. Upbit dominates the market, albeit with declining share, while Bitcoin continues to see resilient demand even amid broader price decreases.

The South Korean cryptocurrency market has established a prominent position globally, characterised by its retail-driven nature. Despite recent volatility, the market largely focuses on a limited number of local exchanges and favours alternative cryptocurrencies (altcoins). This report examines the shifting trends within South Korea’s crypto landscape, assessing its readiness to attract institutional investment.

Part 1: KRW Trade Volume Slows in Q1

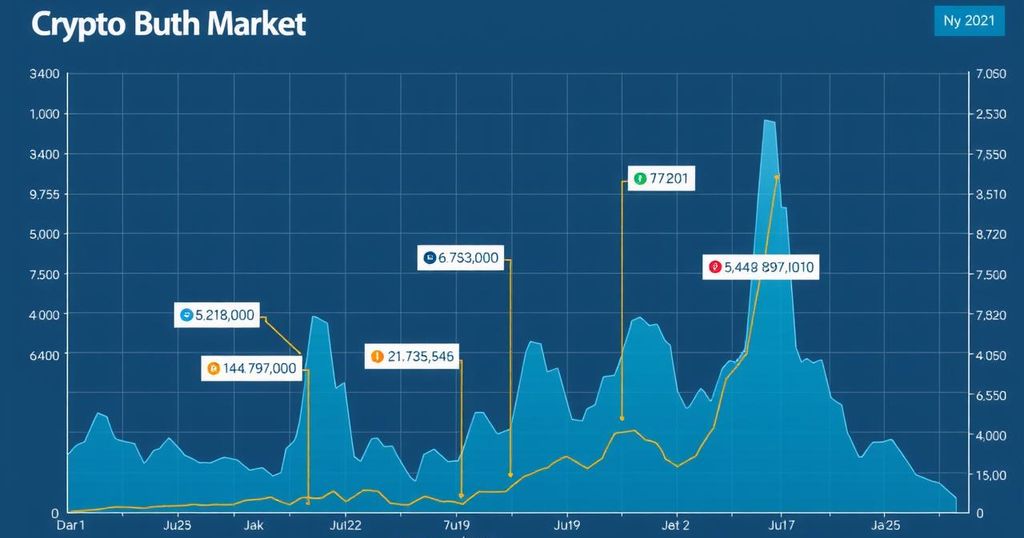

Following a significant peak in 2021, South Korea’s crypto market experienced a resurgence, reaching a monthly trading volume of $300 billion by December 2024. However, early 2025 witnessed a substantial decline in activity, attributed to global trade conflicts and political uncertainty at home. Notably, March volumes plummeted 62% compared to the previous November, despite KRW maintaining its position as the second-largest crypto trading currency, commanding a 35% share of the global market.

Part 2: Competition and Concentration

The competitive landscape of South Korea’s crypto market remains highly concentrated, with Upbit accounting for 69% of the market share as of February 2025, down from a peak of 86% in 2021. This reduction is largely due to rival exchanges implementing fee-free trading campaigns that attracted new users. In addition, Korean exchanges have experienced less significant growth from the post-U.S. election rally relative to their international peers.

Part 3: BTC’s Role in Korean Markets

A notable increase in Bitcoin demand was observed during the December 2024 “Martial Law Crisis,” as indicated by a positive cumulative volume delta (CVD). In contrast, most altcoins faced net outflows. In January 2025, despite a decrease in global Bitcoin prices, a premium persisted on Korean exchanges, suggesting robust local demand. Additionally, the average market depth for Bitcoin surged to approximately $1.3 million on major Korean platforms during Q1 2025.

Post Comment