Ethereum Holds Steady as Massive Selling Pressure Fails to Break Support

Ethereum’s price resilience faces tests amidst large sell-offs, as key support holds yet uncertainty looms. Could a breakout lead to new heights, or will it falter?

Ethereum’s Remarkable Resistance at Key Support Level

Ethereum (ETH-USD) has once again shown resilience, holding steady at $2,344 despite a staggering $2.57 billion sell-off from large holders, or whales, in just two days. This massive dump, which involved roughly 1.06 million ETH, did not break below the critical demand zone of $2,344, a point marked by an accumulation of about 65.83 million ETH, valued at more than $159 billion. This particular price level is proving to be a pivotal support, with bullish sentiment still hanging on; until this support is decisively breached, the bearish narrative remains unconfirmed.

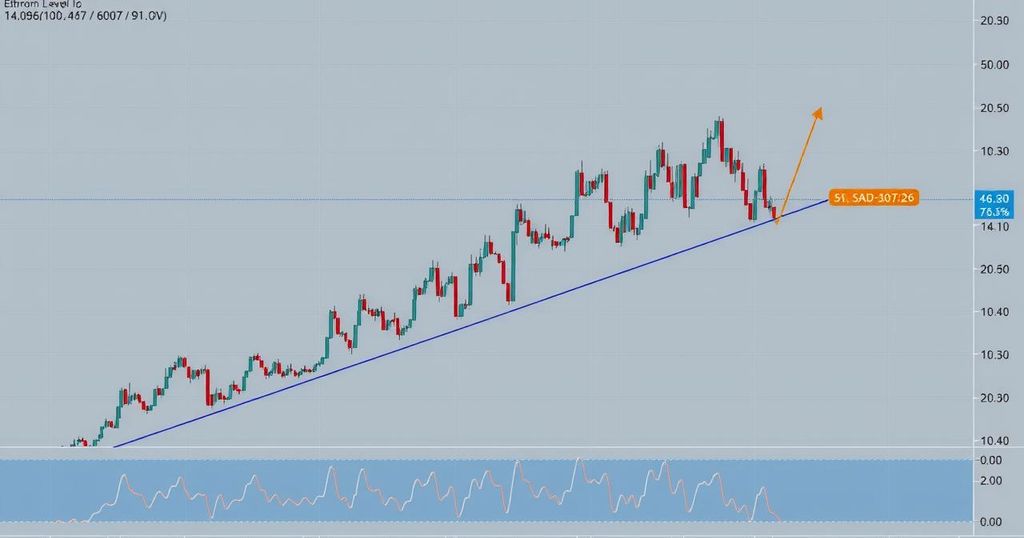

Price Movement and Breakout Potential

In the past couple of days, Ethereum has been trading within a rather narrow range of $2,400 to $2,476. Short-term support is rooted around $2,415, while the upside is currently blocked by resistance at $2,476, which also corresponds with the 200-day exponential moving average (EMA). A breakout above $2,476 could set the stage for a push towards $2,535, and should that level be reclaimed, it could lead to targets at $2,732 and a potential run even higher to $2,850. A confirmed daily close above $2,850 would significantly bolster bullish expectations, paving the way to possible peaks near $3,400 in future trading.

Death Cross and Technical Indicators

However, not all the news is rosy. The technical landscape shows there’s a looming ‘death cross’ warning—where the 50-week moving average approaches slipping below the 100-week moving average. This situation could trigger a bearish trend that might mirror events from November 2022, when Ethereum saw a steep subsequent decline of about 35%. Current momentum indicators present a mixed picture: the Relative Strength Index (RSI) sits near the neutral 51 level while stochastic oscillators are nearing overbought territory. The combination of conflicting signals makes for a rather tense atmosphere in the market.

Accumulative Moves Amid Cautious Market

Interestingly, despite retail fear and overall market cautiousness, notable whale players are taking the opportunity to increase their holdings. Significant inflows from select wallets amounting to 3,800 ETH, or around $9.3 million, indicate that smart money is buying the dip while most are scrambling for safety. On-chain metrics reveal that the accumulation of Ethereum has recently hit new highs, which suggests that there are pockets of confidence that could drive positive price action going forward. However, the price’s lack of immediate response highlights a disconnect between market sentiment and actual fundamentals, an unsettling reality for traders.

Macro Influences Impacting Ethereum

On the regulatory front, recent announcements by President Trump regarding tariffs and interest rate speculation have added layers of complexity to the macroeconomic environment surrounding Ethereum. His directive for retaliatory tariffs has sent shudders through the crypto market, even pushing Ethereum momentarily below the $2,400 mark. The overall market’s sensitivity to such news can’t be understated, as external pressures often contribute to volatility that traders must navigate carefully. The Bloomberg Dollar Index has shown minor declines, which could provide some relief to Ethereum moving forward, but the sentiment remains cautious for now as macro risks persist.

Critical Trade Levels for the Upcoming Period

As we turn the final corner into the heart of the month, the trade setup for ETH-USD outlines key levels to watch. Resistance is firm at $2,470-$2,535, with a solid close above $2,535 potentially opening the floodgates towards $2,732 and the significant breakout level of $2,850. On the flip side, if Ethereum breaks below the $2,390 mark, expectations for swift movement towards $2,205, or even $1,700, would suddenly come back into play, especially in light of the death cross scenario. Traders find themselves facing a market atmosphere that’s akin to a pressure cooker, teetering on the verge of a significant breakout in either direction, which could lead to heightened volatility.

Long-Term Projections and Future Outlook

Staying optimistic, analysts still maintain a long-term outlook reaching for a $10,000 peak. The current structure of Ethereum mirrors past price action seen in previous cycles back in 2017 and 2021, during which explosive rallies of up to 400% were observed. According to expert assessments, a sustained breach of the $3,000 mark could cement the likelihood of that trajectory. Until decisively above $2,850, though, the primary task remains to defend the $2,344 level, while traders should keep a keen eye on broader market developments that could affect momentum.

Final Recommendations for Ethereum Investors

Overall, the current recommendation for Ethereum traders is to hold for now, with clear instructions to buy above $2,535, and consider selling if ETH-USD dips under $2,390. The market’s bullish structure is still intact, albeit constrained by external factors and mounting risks. The verdict is clear — in this precarious trading environment, a significant break in either direction will likely yield rapid movement, stressing the importance of the proper positioning ahead of any major shifts.

Ethereum remains in a precarious position, stable at $2,344 but facing significant selling pressure, yet backed by whale accumulation and a solid technical support framework. As market dynamics fluctuate with macro influences, the future price movements will largely hinge on breaching key resistance levels or a slip below critical lows. In summary, signals suggest cautious optimism exists amid turbulent trading conditions, with the potential for explosive outcomes as traders reposition themselves in anticipation of the next big move.

Post Comment