XRP Price Analysis Highlights Breakout Potential Amidst Tight Range

XRP is currently trading at $2.08 with $121 billion in market cap. The price action shows tight trading range and mixed technical signals. Momentum indicators are neutral, while moving averages present distinct bullish and bearish signals. The outlook suggests caution as traders await decisive breaks above $2.10 or below $2.00 for directional guidance.

On April 19, 2025, XRP is valued at $2.08, with a market capitalisation of $121 billion and $1.43 billion in turnover within 24 hours. Prices fluctuated narrowly between $2.06 and $2.09, indicating low volatility amid mixed technical signals.

The 1-hour chart highlights an initial price near $2.043, peaking at $2.098 before settling back to $2.08, demonstrating mild bullish tendencies. However, the sequence of lower highs post-peak alongside the prevalence of red candles points to diminishing buyer interest. Increased volume in the mid-session followed by decline suggests indecisiveness in the market, warranting further bullish signals to justify new entries.

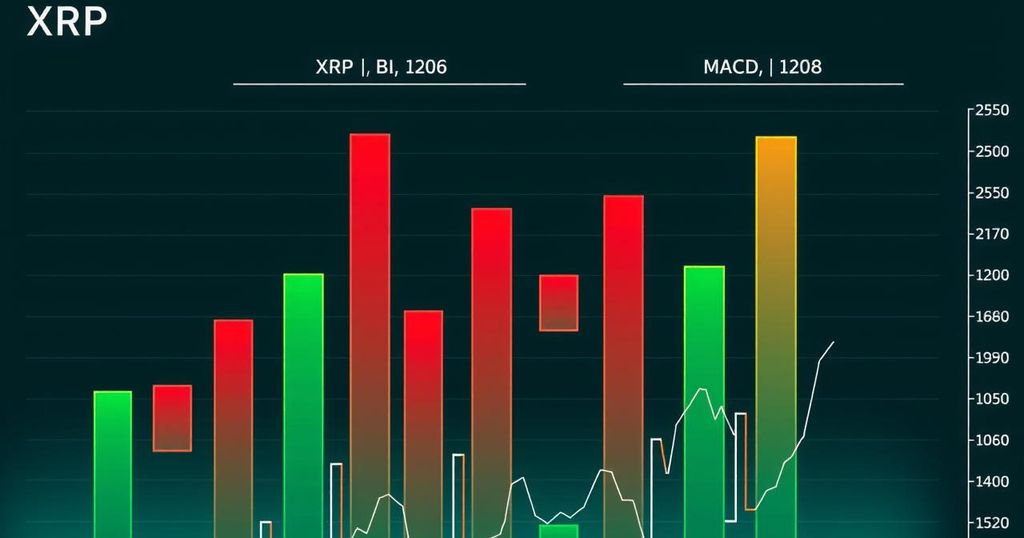

Analysis of the 4-hour chart shows XRP encountering consistent resistance around $2.10, with a notable local high at $2.185 and support positioned at $2.035. The current oscillation within a broadening formation indicates heightened volatility with no clear directional trend. The alternating red and green candles signify a struggle between bulls and bears, while reduced volume could hinder any immediate bullish activity unless fresh momentum is generated. The technical outlook leans neutral with a slightly bearish bias unless the price confirms a break above $2.10.

On the daily chart, XRP is recovering from a severe sell-off, rebounding from a low of $1.613. The highest recorded value within the period was $2.59, but recent stability around $2.08 indicates consolidation. Despite elevated volume during the decline and subsequent recovery, the diminished size of recent candles paired with lower volumes points towards a market likely preparing for the next significant move. It is crucial for traders to watch for a breakout above $2.10 or a breakdown below $2.00 to establish clear directional sentiment.

Current momentum indicators reflect neutral positioning: the RSI stands at 47.53, Stochastic oscillator at 72.30, and Commodity Channel Index at 26.84. The average directional index at 21.08 indicates a weak trend, complemented by a negative Awesome oscillator reading of -0.08575, signalling directionless behaviour. Additionally, the momentum oscillator indicates a sell signal while the MACD offers a buy signal.

The analysis of moving averages reveals indecision across various timelines. The 10-period exponential and simple moving averages indicate bullish potential at $2.07310 and $2.07709, respectively, while the 20-period EMA at $2.09532 and 30-period EMA at $2.13449 suggest a bearish outlook. Nevertheless, the long-term 200-period EMA and SMA maintain support at $1.96045 and $1.93327, signalling positive continuation prospects. The mixed signals highlight ongoing uncertainty about XRP’s future path.

Bull Verdict: XRP’s consolidation above vital support levels and a robust V-shaped recovery support a cautiously optimistic perspective. A solid break above $2.09, confirmed with volume, may lead bullish traders toward resistance levels around $2.15 or higher.

Bear Verdict: Despite some short-term buying indicators, waning momentum and mixed signals from moving averages caution against over-enthusiasm. Failure to hold the support at $2.06 could result in a decline to around $2.00 or lower, favouring bearish movement in the near future.

Post Comment