Bitcoin Approaches $90K: Insights from Cost Basis Analysis on Market Dynamics

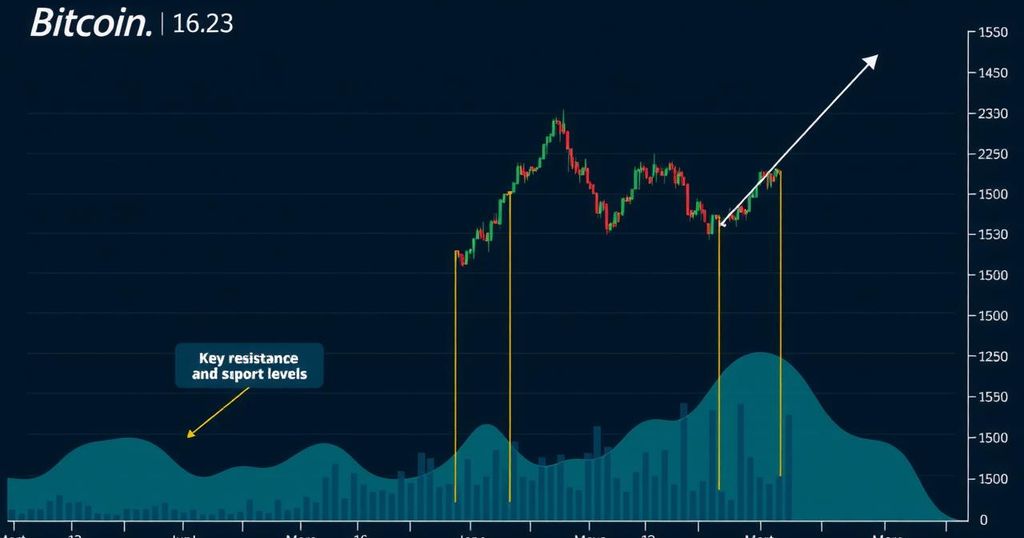

Bitcoin has risen to approximately $89,062, nearing the $90,000 mark. On-chain analysis highlights crucial cost basis zones: $91,500 for short-term holders (resistance) and $83,700 for newer holders (support). Monitoring these levels may provide insights into market behaviour and potential price movements going forward.

Bitcoin is currently trading at approximately $89,062, reflecting a 2.3% increase over the past 24 hours, as it shows renewed momentum following a recent corrective period. The asset’s proximity to the $90,000 mark focuses attention on how different investor cohorts’ cost basis may influence future price movements. As traditional resistance and support levels remain relevant, an emerging data-driven approach through on-chain analysis is becoming increasingly significant.

Insights from CryptoQuant contributor Crazzyblockk reveal crucial cost basis levels among different Bitcoin holder segments, indicating potential areas of significant price reactions. These levels, derived from realized prices across various age groups of Bitcoin holdings, highlight probable support and resistance zones within the market. Understanding realised prices enables traders to anticipate investor behaviour as Bitcoin’s market dynamics evolve.

Currently, short-term holders, defined as those who have held Bitcoin for up to 155 days, reflect an average cost basis of approximately $91,500, which serves as a critical resistance point. Conversely, newer holders, particularly those within the 1-3 month range, demonstrate an average cost basis of about $83,700, which is acting as a support zone. If Bitcoin consistently trades above this support level, early investors may be incentivized to hold, which would mitigate short-term selling pressure.

The analytical framework is based on segmenting Bitcoin’s Unspent Transaction Outputs (UTXOs) according to age, therefore calculating realised prices for each group. This process provides valuable insights into investor profit or loss clusters, explaining that these cost basis zones offer dynamic support and resistance levels derived from market behaviour rather than traditional technical indicators. If Bitcoin successfully surpasses the short-term holder level of $91,500, it may indicate a continuing bullish trend, while a decline below the $83,700 support level could generate new selling pressure from those who acquired during the recent price surge.

Post Comment