Surge in Bitcoin Futures Liquidity: A Market Analysis

Bitcoin futures have experienced a significant liquidity surge, with positions totaling 57,000 BTC valued at $5.34 billion. This increase aligns with Bitcoin surpassing the $93,000 mark. Long positions rose by 33.71% and open interest saw a 14% rise to $121.6 billion, indicating bullish market sentiment but also potential for increased volatility.

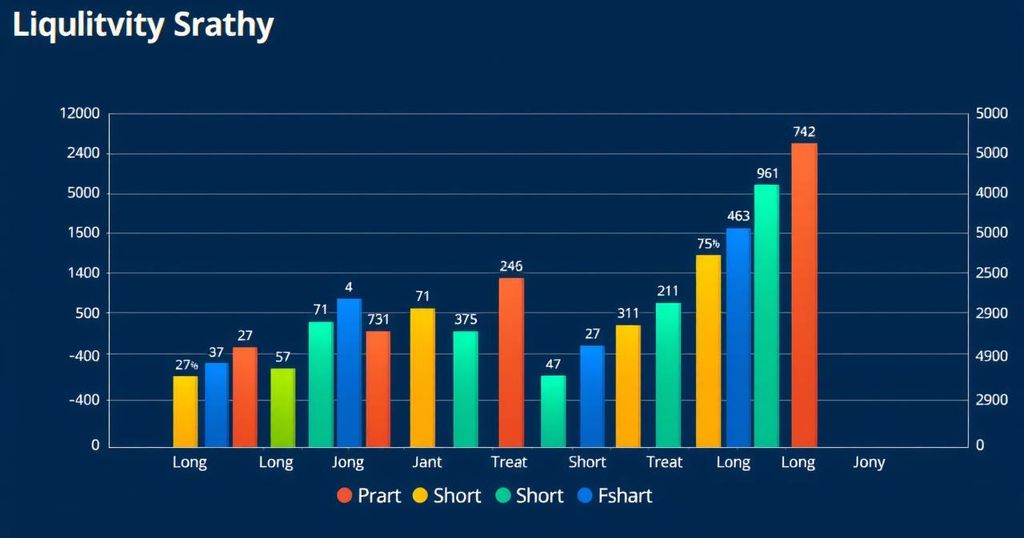

Recent analysis by CryptoQuant’s Axel Adler Jr highlights a significant surge in Bitcoin futures liquidity, estimating a total of 57,000 Bitcoin (BTC) positions opened in just three days. This increase, identified alongside Bitcoin surpassing the $93,000 mark, has led to positions worth approximately $5.34 billion, marking the largest liquidity growth in the past year.

In the 24 hours preceding this report, long Bitcoin positions rose by 33.71% to reach $74.4 billion, while short positions decreased by 27.5% to a total of $68.2 billion. As of April 23, long positions constituted over 44% of all open trades, with short positions at 55%. The trading price of Bitcoin was noted at $93,615, with intra-day peaks hitting $93,777.

Moreover, approximately $602 million was liquidated from the cryptocurrency market within the last day, which reflects a 130% increase in liquidations. Concurrently, the open interest for Bitcoin futures rose by 14%, standing at $121.6 billion, indicating a larger accumulation of trading positions in the market.

The notable uptick in futures positions suggests an increased bullish sentiment among traders, potentially fostering a rally in Bitcoin’s price and mitigating significant corrections. The recent collective open interest across trading platforms, led by CME and Binance, has reached historic highs, illustrating the derivatives market’s expanding ability to handle large volumes without severe slippage.

However, this rapid increase in open interest also raises the likelihood of heightened market volatility. Should Bitcoin’s price decrease, there could be significant liquidations of positions, potentially triggering further market declines, as traders may be compelled to exit their current holdings under adverse conditions.

Post Comment