Ethereum Price Analysis: Potential Breakout or Drop Below $1,400?

Ethereum’s price is at a critical junction, currently above $1,620 with resistance at $1,650. Analysts highlight both bullish patterns from the TD Sequential indicator suggesting a potential rebound, and bearish pressures indicated by a Fair Value Gap and Stochastic RSI readings, making it uncertain whether the price will surpass $1,700 or fall below $1,400. Market sentiment remains mixed with Ethereum’s dominance nearing historical lows.

The Ethereum price is currently in a critical phase, trading just above $1,620 and facing resistance near $1,650. Analysts have identified both bullish and bearish indicators in ETH’s price movement, leaving traders uncertain about whether it will break past $1,700 or test the $1,400 support.

The analysis highlights a Fair Value Gap (FVG) created during a sell-off on April 7, which sits between $1,600 and $1,670. Ethereum struggled to reclaim this level during multiple rallies, indicating persistent selling pressure. It is also trading within the Fibonacci golden pocket. A sustained rejection here could lead to a decline towards $1,400 or below if resistance at the 0.786 Fibonacci level of $1,724 is not breached.

The Stochastic RSI has shown signs of bearish momentum as it nears overbought levels, suggesting a potential slowdown for Ethereum. Analysts believe that a resumption of selling pressure could push the price down towards the $1,400 area again.

Contrarily, a bullish signal is noted by crypto analyst Ali, who points to the TD Sequential indicator flashing a buy signal on Ethereum’s weekly chart. This indicator is often used to identify potential reversals in price trends. Despite ETH’s consolidation, the weekly buy signal hints at a possibility of a rebound, though it must first convert the $1,700 resistance into support.

Market sentiment regarding Ethereum is mixed, with its market dominance nearing all-time lows recognised back in 2021. Rekt Capital notes that ETH’s recent drop into critical support areas might signal a potential recovery for the broader altcoin market, albeit currently indicating underperformance against Bitcoin.

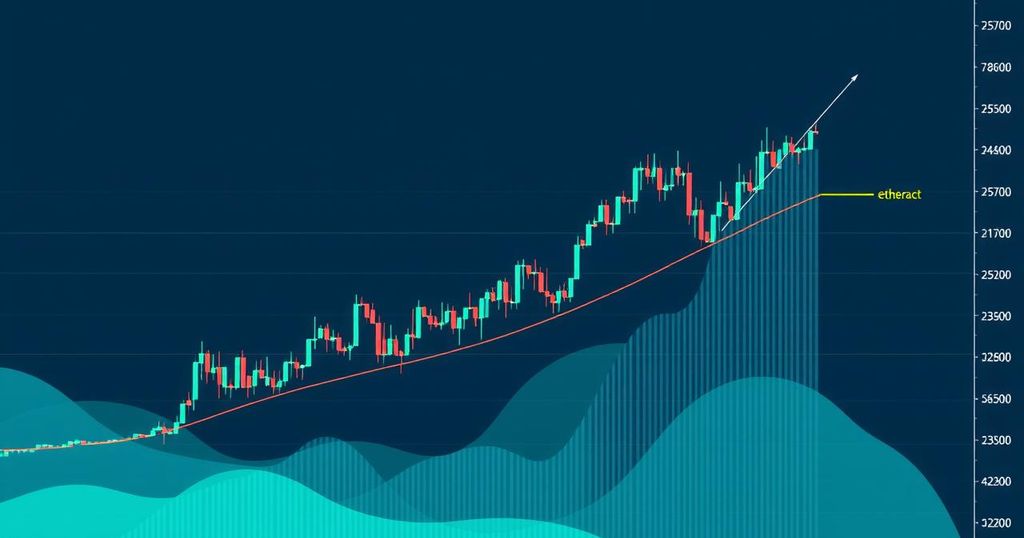

Merlijn The Trader suggests Ethereum is poised for a breakout, describing its current setup as a bullish pennant. While some long-term holders expect significant price increases post-breakout, others, including BOBO, warn of an impending decline before any recovery. They caution that the current formation resembles a descending triangle, indicating short-term risks.

Ethereum is at a crossroads where bullish signals and potential bearish indicators create an uncertain outlook. Should ETH reclaim $1,724, it may gain upward momentum; however, failure to maintain current levels could lead to declines toward $1,400, or more.

Post Comment