Bitcoin Eyes $95,000 Amid Major ETF Inflows and Whales Accumulation

Bitcoin’s price is surging towards $95,000 thanks to bullish ETF inflows and whale accumulation. Major inflows totalling $1.8 billion in two days, alongside positive sentiment from large investors, is driving demand upwards. However, if Bitcoin fails to hold above $89,800, a reversal could lead to losses.

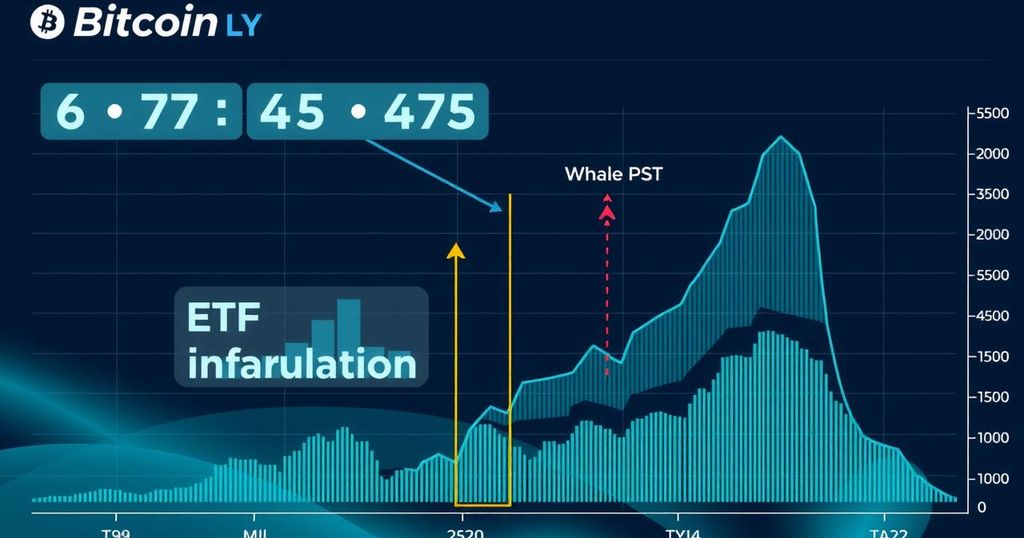

Bitcoin has recently gained impressive ground, confirming a bullish trend and stoking optimism among investors. This rally appears to be fueled primarily by significant inflows from Bitcoin Exchange-Traded Funds (ETFs), along with heavy accumulation activities by major investors known as whales. With these two factors in play, analysts suggest that Bitcoin might be gearing up to hit new price highs soon.

Whale behaviour continues to play an important role in driving Bitcoin’s price upwards. As reported, whales—those who hold over 10,000 BTC—are showing strong confidence with an accumulation score nearing 0.9. This points to a widespread belief among large investors that a bullish trend is sustained. Meanwhile, those holding between 1,000 and 10,000 BTC show a slightly lower score of 0.7, indicating that even smaller investors are inspired by whale activity and are increasing their positions in the market.

The recent macro environment for Bitcoin looks increasingly positive, particularly due to the noteworthy inflows from ETFs. Within just the last two days, inflows to Bitcoin ETFs touched a staggering $1.8 billion, including $912 million on April 22 and $917 million the following day. This marks the highest single-day ETF inflow noted in over five months, reflecting a solid rise in demand and investor confidence in Bitcoin’s future.

With such aggressive inflows from both institutional and retail investors, market sentiment surrounding Bitcoin seems to shift toward positivity. Increased interest in Bitcoin ETFs will likely reinforce the price rise potential for Bitcoin, establishing a cycle that could see prices climbing in the near term.

Currently, Bitcoin sits at $92,347, cheekily hovering just below the critical resistance level of $93,625. Although Bitcoin has made a few attempts at breaking this milestone, it hasn’t quite succeeded yet. However, given the bullish patterns and favourable market dynamics, there are anticipations that it might soon punch through this resistance.

Earlier this week, the cryptocurrency demonstrated a successful double-bottom pattern, spiking by 10% in just a couple of days. This initial breakout strengthens the bullish narrative surrounding Bitcoin. With whale support and ETF inflows in its corner, Bitcoin appears primed to challenge the $93,625 barrier, and if it does, it could even target the $95,000 price range—possibly even reaching up to $95,761.

Yet, it’s not all roses. Should Bitcoin lose its upward momentum and dip below the $89,800 support level, this could trigger a bearish flip. Falling below this support would challenge the bullish outlook, potentially sending the price way down to around $86,822, wiping out some of the recent gains.

Post Comment